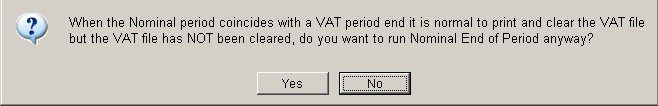

Warning – Uncleared VAT File

Appears during Nominal End of Period routine.

Because… As the Message states, it is normal to print and clear the VAT file before running Nominal Period End when the nominal period coincides with a VAT period end. This is because the VAT file accumulates the VAT report figures for the VAT reporting period.

When a VAT period-end is reached the VAT file must be cleared to ensure it begins to accumulate figures for the next VAT period. Print the VAT report before doing so to ensure you have the correct figures to include with your VAT reporting submission – see VAT Summary form, VAT At-a-Glance form, VAT Return form.

Therefore… To continue without clearing the VAT file could compromise your cumulative VAT figures.

Actions … Cancel the Nominal End of Period, print , submit your VAT return to clear the VAT file and return to complete the Nominal Period End.

0 Comments