Sales Ledger – Produce Debtors Letters

Purpose:

Produce whenever necessary as part of the credit control function of the business.

Debtors Letters are a follow up to Customer Statements and are usually addressed to a named contact within the customer’s organisation, often in their accounts payable section. The letter shows a single overdue amount and reminds the customer of their obligation to settle the amounts due, and/or informs them of any further action that will be taken if the debt is not settled within a specified time.

These are usually produced each month at the same time as printing Customer Statements. The system comes with standard wording already created for you to use.

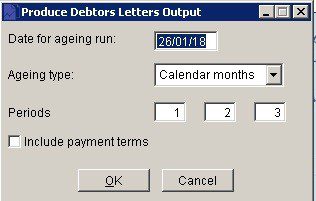

This facility allows you to produce files in a commonly accessible format (CSV) that contain details of Customers’ debts. The date entered in the ‘Date for Ageing Run‘ field is the date used to calculate the ages of the debts. The ‘Ageing type‘ and ‘Periods‘ are initially the same as the ones set up in the sales parameters, but may be overridden if required.

The files are called DEBTS1.CsV, DEBTS2.CSV and DEBTS3.CSV and contain the names and addresses of customers whose debts fall into the ‘Period‘ as defined above. Fields are also included which provide details of the amount of the debt, its age, etc. The files are saved in the data export of your company – usually C:\My Documents\ Prelude and can be used with a Mail Merge facility of an MS compatible word processing program.

Preparation:

Create 3 standard letters using an MS compatible Word Processing Package.

Ensure that you discuss and agree wordings with the Sales Department.

Consider using fax/email of letters to save cost and time.

Processing:

On the main menu click Ledgers > Sales > Reports > Debtors Letter Output – see Debtors Letter Output form below.

Reporting:

Agree target customers with the Sales Department before letters are sent out.

Filing:

File a .pdf copy of the letters with customer documents.

Date from which ageing is calculated.

Either: Manual entry formatted as DD/MM/YY. Type over the parts of the date you wish to change – the system will skip over the “/” parts itself. If the date you enter is invalid the cursor will return to the start of the date and await a valid entry, or; click on the field to highlight data – white on a blue background – then right click to open the Calendar Menu – see Dates and Calendar.

Ageing type: The ageing of a transaction, be it an invoice, payment, etc., is based on the amount of time that has passed between the transaction’s date and the default transaction date. For reporting purposes, this time is grouped into three periods, and the amount of the transaction is then classed as ‘Current’ – not older than period 1, ‘Over period 1’ – but less than period 2, ‘Over period 2’ – but less than period 3, and ‘Over period 3’. The amount of time within these periods is specified in the Periods field.

Select ‘D‘ for days, ‘M‘ for months or ‘C’ for calendar months or ‘E‘ for end of month from the drop down box.

D Period days from transaction date

e.g. transaction date = 23/09/2018, Period = 0, Due date = 23/09/2018

e.g. transaction date = 23/09/2018, Period = 15, Due date = 08/10/2018

e.g. transaction date = 23/09/2018, Period = 30, Due date = 23/10/2018

E Period days from end-of-month of transaction date

e.g. transaction date = 23/09/2018, Period = 0, Due date = 30/09/2018

e.g. transaction date = 23/09/2018, Period = 15, Due date = 15/10/2018

e.g. transaction date = 23/09/2018, Period = 30, Due date = 30/10/2018

M Period months from transaction date, or last day of the month if the calculated date doesn’t exist

e.g. transaction date = 23/09/2018, Period = 0, Due date = 23/09/2018

e.g. transaction date = 23/09/2018, Period = 1, Due date = 23/10/2018

e.g. transaction date = 23/09/2018, Period = 2, Due date = 23/11/2018

C Period end-of-months from end-of-month of transaction date

e.g. transaction date = 23/09/2018, Period = 0, Due date = 30/09/2018

e.g. transaction date = 23/09/2018, Period = 1, Due date = 30/10/2018

e.g. transaction date = 23/09/2018, Period = 2, Due date = 30/11/2018

Periods: Periods for ageing starting with the earliest on the left. Input depends on Ageing Type selected – as an example ; Ageing Type set to ‘D’, periods set to 30 (days), 60 (days) & 90 (days). Reading from left to right – these are the selection criteria for Debts1, Debts2, Debts3; calculated as the input number of periods overdue

Include payment terms: Check to apply any payment terms – see Customer Account – Financial Page – to the balance outstanding with each reported customer. The effect is to reduce the ageing of the customer account balance by the payment term period, removing the customer from the report entirely if the payment terms are sufficiently distant. Useful if you have extended credit terms with some customers and want to exclude them from statement runs and credit control – see Aged Debtors Report Form.

0 Comments