Costing – Create Or Amend Cost Codes

Purpose:

Cost codes are used to quantify the cost of goods or services expended or generated by a Job or Workstream.

Cost is made up of a base cost (input as a standard value for a category or an invoiced amount) plus overhead (either calculated as a percentage of base cost or a fixed amount). Overhead can also be charged as a base cost.

Cost code types and lists (see Lists Maintenance) should be updated to reflect any changes as soon as these take place. Data based on budgeted standard costs will need to be updated when the underlying budgets are changed.

Preparation:

For first time use only; list required categories and agree formats and descriptions with process owners.

Print an up to date list of Cost Codes – see Costing Reports – and agree any changes in cost or overhead recovery rates with Sales and Finance Departments and Budget Owners.

Ensure Employee, Priority and Equipment Lists are complete and up to date – see Lists Maintenance.

Agree the value of any write offs with the Budget Owner.

Processing:

On the main menu click Costing > Cost Code Maintenance > click on required Cost Code Type to open form.

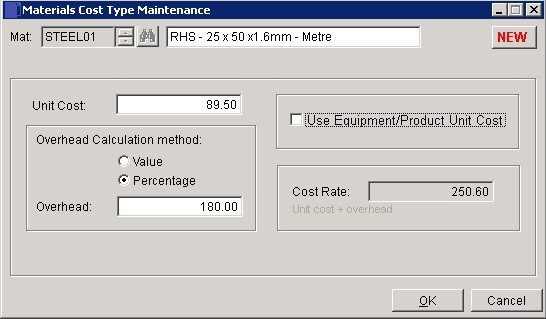

Materials:

Use to charge Workstreams and Jobs with the cost of goods supplied by third parties, equipment and/or items issued from stock.

Cost rates are calculated as Unit Cost plus Overhead calculated as a value or percentage.

- Mat: create a new Code – type in a new code into the code field (max 7 characters.) To amend an existing code click Search to open form to locate required code.

- Description: up to 30 Characters.

- Use Equipment/Product Unit Cost: Check to value transactions posted to Jobs using the Post Cost Option – see Record Contract and Job Costs – as the cost of, either; when being posted as an entry on the Equipment Charges page of the Post Cost Form, a specific piece of Equipment selected by name – see Lists Maintenance, or: when being posted as an entry on the Stock Used page of the Post Cost Form, a specific item of Stock – see Create & Edit Products and Services.

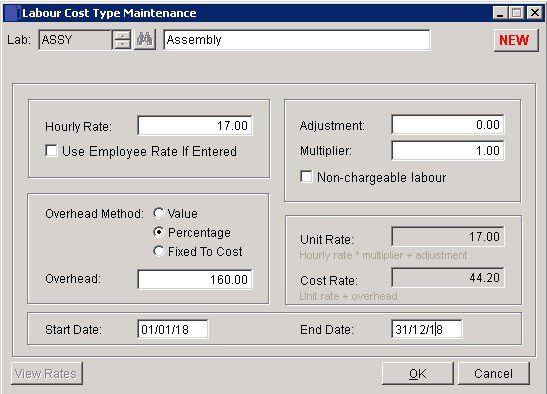

- Labour:Use to calculate Chargeable Rates and record Non Chargeable time (zero cost) for different employee grades and skill sets. Rates are calculated as a Basic Hourly Rate plus Overhead calculated as a value or percentage plus a multiplier to adjust for any overtime premiums.

- Lab: To create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Adjustment: Amount to be applied as a multiplier to the Hourly Rate to reflect Employers National Insurance and Pension Costs.

- Multiplier: Uplift of hourly rate for overtime working.

- Non-chargeable Labour: Check to record time and not cost when posting timesheets to Jobs.

- View Rates: Click to display a List of Employees and their Hourly Rates.

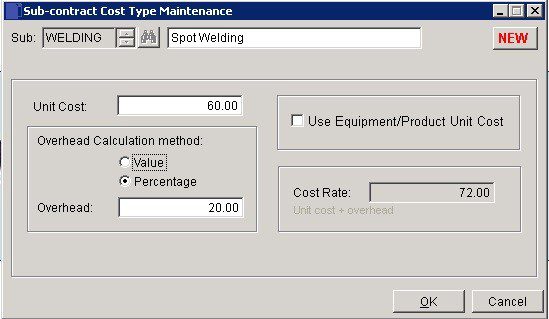

Sub-Contract: Use to charge the cost of tradesmen or third party temporary or agency staff to a contract or Job. Cost rates are calculated as Unit Cost plus Overhead.

- Sub: To create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Description: up to 30 characters.

- Use Equipment/Product Unit Cost: Check to value transactions posted to Jobs using the Post Cost option – see Record Job or Workstream Costs – as the cost of, either; when being posted as an entry on the Equipment Charges page of the Post Cost Form, a specific piece of equipment selected by name – see Maintain Lists, or: when being posted as an entry on the Stock Used page of the Post Cost Form, a specific item of stock – see Create & Edit Products and Services.

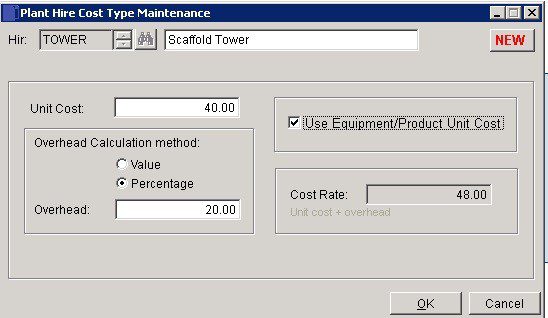

Plant Hire:

- Hir:To create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Description: up to 30 characters.

- Use Equipment/Product Unit Cost: Check to value transactions posted to Jobs using the Post Cost option – see Record Job or Workstream Costs – as the cost of, either; when being posted as an entry on the Equipment Charges page of the Post Cost Form, a specific piece of equipment selected by name – see Lists Maintenance, or: when being posted as an entry on the Stock Used page of the Post Cost Form, a specific item of stock – see Create & Edit Products and Services.

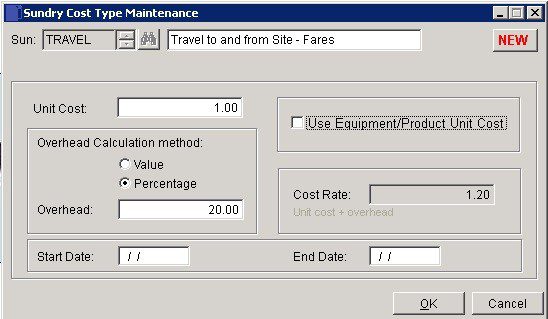

Sundry:

Use for costs other than Materials, Labour or Sub-contract, such as Professional Fees or Consumables. Cost rates are calculated as Unit Cost plus Overhead.

- Sun: create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Description: up to 30 Characters.

- Use Equipment/Product Unit Cost: Check to value transactions posted to Jobs using the Post Cost option – see Record Contract and Job Costs – as the cost of, either; when being posted as an entry on the Equipment Charges page of the Post Cost Form, a specific piece of equipment selected by name – see Lists Maintenance, or: when being posted as an entry on the Stock Used page of the Post Cost Form, a specific item of stock – see Create & Edit Products and Services.

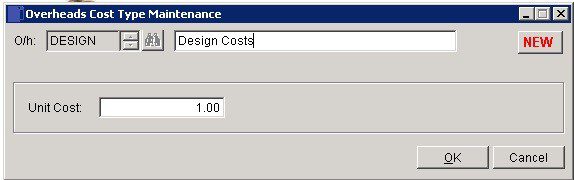

Overheads:

Use to charge overhead directly to a Contract or Job.

- O/h: create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Description: up to 30 Characters.

- Unit Cost: Value of base cost for this cost type.

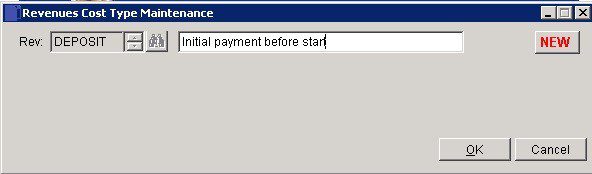

Revenues:

Use to record the value of Sales Invoices issued to customers. The system distinguishes between Retention and other sales.

- Rev: Create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Description: up to 30 Characters.

Write-Offs:

use to record any amounts written off in relation to a Job or Workstream.

- Off: Create a new code – type in a new code into the code field (max 7 characters). To amend an existing code click Search to open form to locate required code.

- Description: up to 30 Characters.

Filing:

Print a Cost Code list – see Costing Reports – and file in a secure location. Distribute as necessary.

0 Comments