POP – Match Supplier Invoices to Purchase Orders

Purpose:

Supplier invoices can be processed with or without using the Purchase Register – see seamless Order to Payment processing Cycle. Invoices should be matched to purchase orders to enable you to establish and control what orders are awaiting invoicing and therefore the potential liability.

Preparation:

The following list of possible preparation steps will help you decide if you need to do anything before processing and if you need help.

- Select a company – see Change Companies.

- Obtain an up-to-date supplier list – see List Suppliers.

- Obtain an up-to-date nominal code list – see List Chart of Accounts.

- Ensure supplier account details are up to date – see Create & Edit Supplier Accounts.

- For first time use only: On the main menu click View > Parameters > Purchase Order Processing – see Purchase Order Processing Parameters – General Page. Set parameters as required.

- Discuss and agree any tolerances to be set – for example, management may decide not to reject a supplier Invoice if an order line item invoice cost differs to the order cost by less than or equal to 1%.

- Change the system date as required – see Change Default Accounting Date.

Processing:

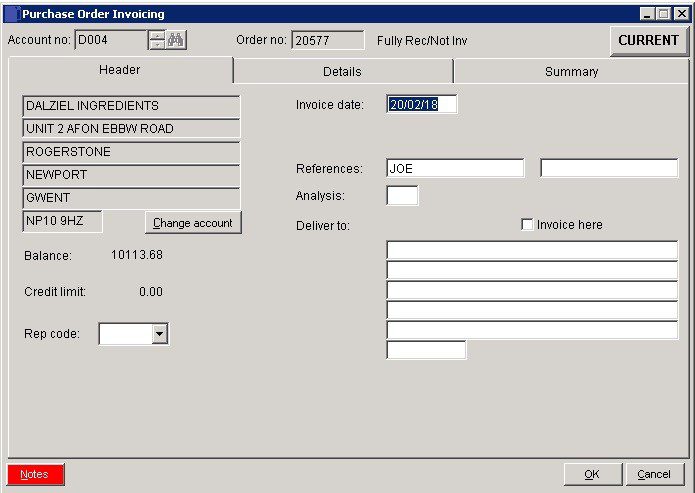

On the main menu click Orders > Suppliers > Receive Invoices to open form.

Message box appears. click Yes to post to the next period, No to post to the current period.

Either: Click OK to open form – see Purchase Order Selection form and select the required order from the list of all open orders displayed, or; using the Account Number Combo Scroll & Search Box click on up and down arrows to scroll through list, and click OK or press Return when required selection is displayed, or search for required code.

Once the supplier is selected click OK.

Click OK to confirm selection and open form.

Complete form details– see Purchase Order Invoicing form – below.

Click OK to update records

Filing:

File GRNs with supplier Invoices as required.

Date: Either: manual entry formatted as DD/MM/YY. Type over the parts of the date you wish to change – the system will skip over the “/” part itself. If the date you enter is invalid; the cursor will return to the start of the date and await a valid entry, or; click on the field to highlight data – white on a blue background – then right click to open the Calendar Menu – see Dates and Calendar.

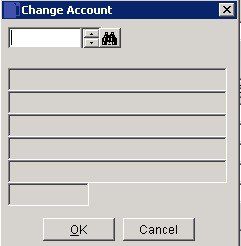

Change Account

- Select and click OK to update.

- References: 2 Fields – Type in a maximum of 16 characters in each field.

- Analysis: Maximum 2 characters account specific – customers can be grouped together for reporting. Defaults to code shown on ledger account – see Sales Analysis.

- Notes: Open Notes Form and enter text as required. Notes are stored as a permanent record and are specific to a Ledger account or Product or Service. They can be read and updated at any time by any user with access to the company. Entries should ideally show a date and the name or initials of the author.

- Entries will make a NOTES flag visible whenever the Ledger Account/Product is selected.

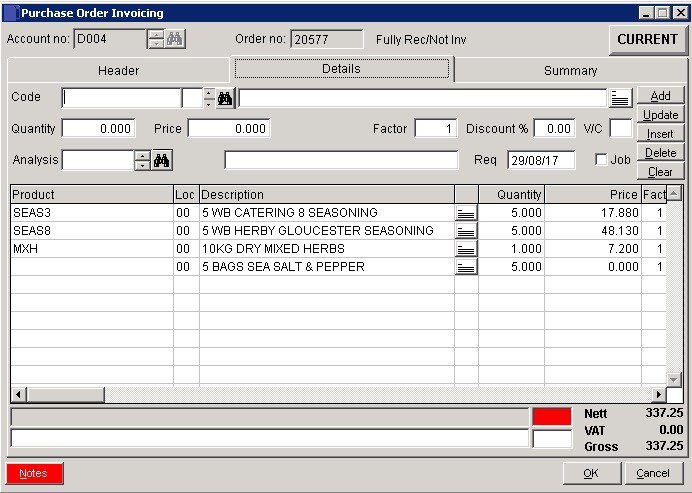

- Select or search for product – Description displays – overwrite if required.

- Add Quantity, amend Price if necessary, amend VAT Code if necessary.

- Enter or select other detail, then click Add to place on grid.

- Line notes: Press button next to Add to display the line notes form. Enter notes that are specific to this line item in this transaction.

- Button turns red when a line item contains notes. Can be edited the same way as other grid items.

- Can be printed on stationery – see Include line notes in stationery design.

- Analysis: Select required nominal code.

- Note Stock availability.

- Update: Select line on grid. To amend, click on Update to take to top – amend details and click on Update again to take back to grid.

- Insert: After filling in details highlight line below where you want to insert and click on Insert.

- Delete: Highlight line to delete and click Delete.

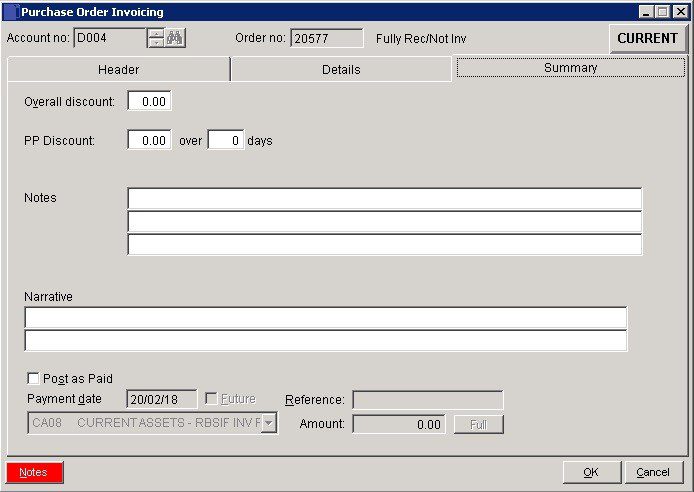

- Overall Discount: Discount applying to Total Invoice value.

- PP Discount: Prompt payment discount available for settlement within number of days from invoice date.

- Notes & Narrative: Text which can be displayed on invoices/credit notes as required by including these fields on your stationery design – see Stationery design

- OK: Generate and print Purchase Order.

- If Use document reprints field is checked in parameters click Yes to reprint – see POP – Entry & Printing Options.

0 Comments