Post Sales Invoice

Purpose:

To post invoices individually created from outside of the system.

Preparation:

If you wish to use your own invoice numbers change the settings in Set Customer Preferences.

Processing:

Click on Customer > Post invoice.

Opens the Select Customer form – see Edit Customer to view form.

Select the customer from the dropdown box or the cloud link list.

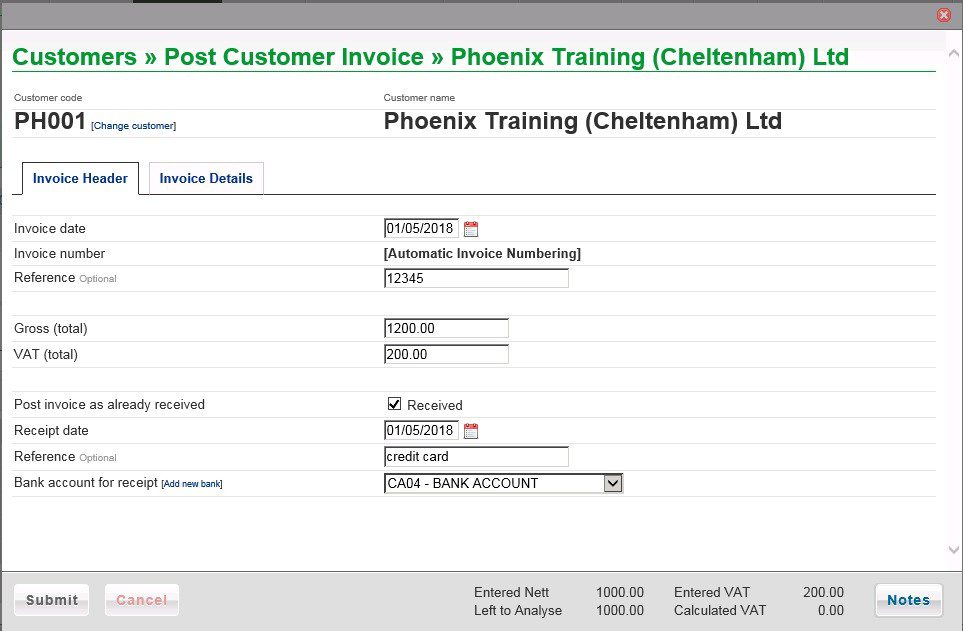

The Post Customer Invoice form opens –

Header Page

- Enter date – see datepicker.

- If configured to use invoice numbers enter the number – see above.

- Enter a meaningful Reference.

- Enter total amount (Gross) from the invoice.

- Click on Invoice Details tab –

Note: You can change the customer if the wrong one selected, and add a new bank.

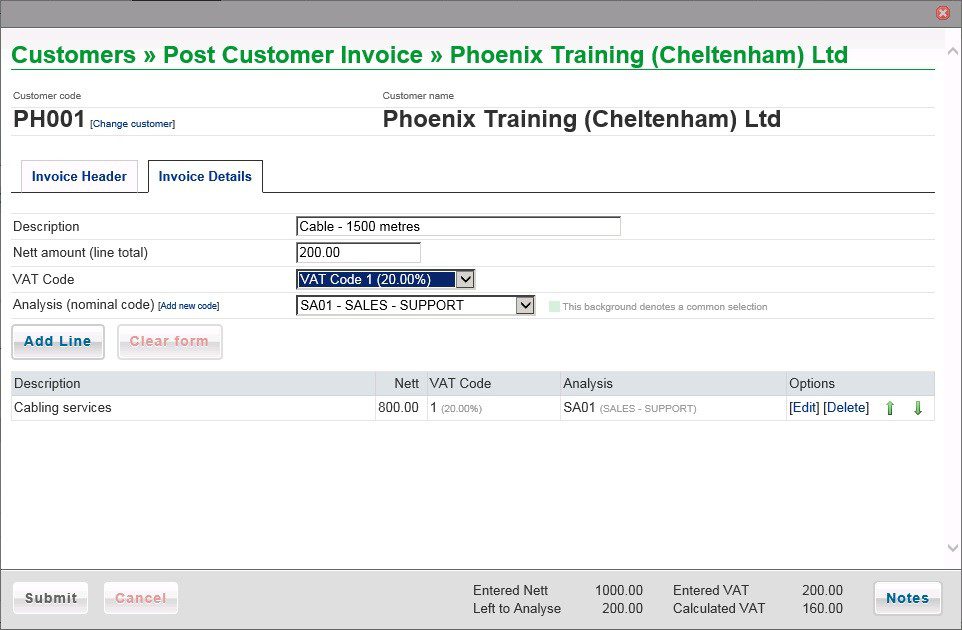

Details Page

- Enter a Description for each line on the invoice.

- Enter Nett amount for the line, select VAT Code and Analysis Code.

- Click on Add Line to add to grid and update Calculated VAT.

- Repeat until Left to analyse = nil and Entered VAT and Calculated VAT are the same – you may need to amend the VAT on a line – Click on [Edit] on the appropriate line in the grid.

- You can also delete a line and re-enter if necessary.

- When done, click on Submit to post invoice to the Ledgers.

- The Notes button allows you to update notes relating to the customer.

- Note: you can create a new nominal code if necessary.

You can also post VAT only invoices (corrections) as follows –

Enter the Gross amount on the header tab and the same amount into VAT. On the Invoice Details tab leave the net amount as 0.00 Add Line and Submit.

0 Comments