The Process For Accountants And Businesses

This is a brief overview of the process for Accountants and Businesses to prepare themselves for VAT – Important steps are highlighted in

bold blue

for Accountants and

bold green

for Businesses.

For accountants

- Create an Agent Services Account (ASA). You will need your Government Gateway account details. Your ASA number will be in the format – XARN-123-4567 and will be needed to access the account in future. Click the following link to go to the HMRC website and create your ASA. https://www.gov.uk/guidance/get-an-hmrc-agent-services-account

- Link clients to your ASA . From your ASA, you will register each client by using their GGW ID (Government Gateway) – Note: this only links the client to you – It does not sign them up for MTD.

- Get authority from your client. You will receive a link to be pasted into an email to which the client must respond before the deadline given or you have to go through the authority process again.

For businesses

- The accountant will be notified that the client has accepted or declined. If accepted, the client can then sign up for MTD or the accountant does it on their behalf – which is what will probably happen.

For accountants

Sign up for MTD The accountant logs in to his GGW account and is directed to his ASA where he can sign his clients up using their GGW IDs. If the accountant doesn’t have an ASA, a message will be displayed advising to obtain one – otherwise the sign-up form will be displayed.

For businesses

From 7 December 2022 HMRC will be registering all VAT registered businesses for MTD automatically anf the VAT portal will no longer be available. There are exemptions to this, but businesses will be notified in either case.

Sign up your clients if you’re an agent

If you’re an agent, use the Government Gateway user ID you got when you registered for an agent services account – https://www.gov.uk/guidance/get-an-hmrc-agent-services-account

Sign up your clients for Making Tax Digital for VAT – Read the above page and particularly note this section –

- Sign into your agent services account and begin to request authorisation from your clients.

- Create individual Government Gateway user IDs for your staff and set permissions to manage their access to services and clients.

and the help section below this.

Once signed up, you can use your Prelude software to submit your MTD-compliant VAT return.

From 7 December 2022 HMRC will be registering all VAT registered businesses for MTD automatically anf the VAT portal will no longer be available. There are exemptions to this, but businesses will be notified in either case.

In Prelude VAT Filer module

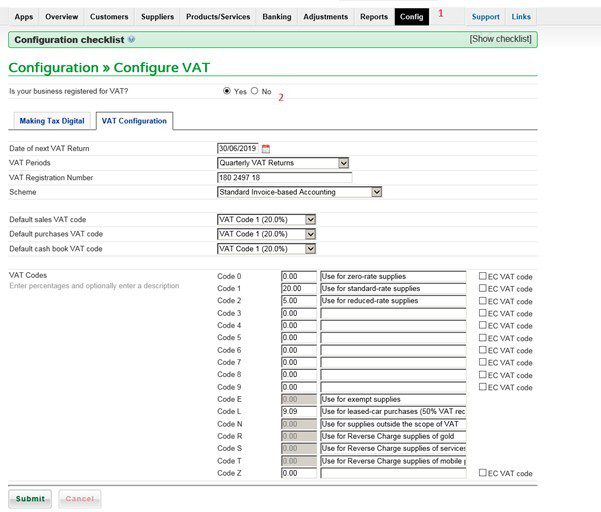

- Go to Config > Configure VAT.

- Click on the radio button – Yes.

3. Check the details on this page and amend as necessary – you can Submit now or later.

Note: The VAT periods are: Monthly. Two monthly. Quarterly, Annual and Other – ‘Other’ allows entry of start and end dates.

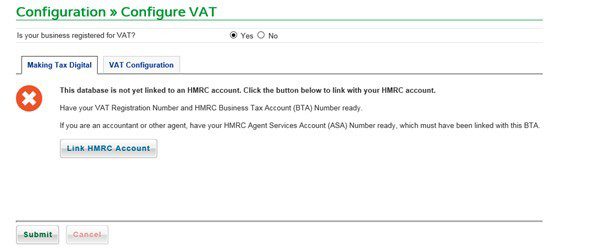

4. Click on the Making Tax Digital tab

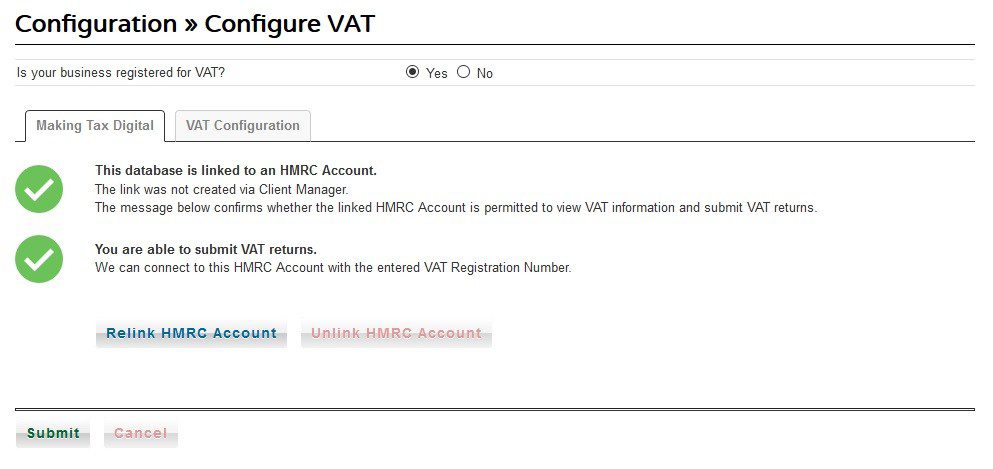

Click on Link HMRC Account, Scroll down first page to ‘Continue’ then fill in the Government Gateway details. At the end of the process click on ‘Grant Authority’ . You will then be brought back to this screen where you should see two green ticks as below – the link has been successful. If not successful you may not have registered – if you’re certain you have, please contact 0300 200 3700.

What penalties may be charged?

If you miss the deadline for submitting your return, we will record a ‘default’ on your account. You do not pay a charge the first time you default. If you default again within 12 months, you may have to pay a charge in on top of the VAT you owe. You can find more about default surcharge on GOV.UK.

From January 2023 HMRC are introducing simplified penalties for late submissions and payment.

Late submission penalties will work on a points-based system. If you do not submit your return on time, you may receive a late submission penalty point and a fine.

Late payment penalties may be charged if you do not pay on time, depending on how late the payment is.

You can find more information about new VAT penalties on GOV.UK or join HMRC’s webinars for businesses.

Re-registration

Every 18 months or so you will be required to re-register. To do so you will need your Government Gateway login and password. You will receive a 403 error message to indicate that you need to re-register. Click on ReLink HMRC Account, Scroll down first page to ‘Continue’ then fill in the Government Gateway details. At the end of the process click on ‘Grant Authority’ . You will then be brought back to this screen where you should see two green ticks as above- the relink has been successful. If not successful wait a few days then check and try again – if there’s still an issue please contact 0300 200 3700.

To submit your VAT return go to Reports > VAT return. When ready to submit. Print using the PDF button. Click on the check box and Lock the return. Then tick the check box and Submit the return.

0 Comments