Cash Book – Post Nominal Payments

Purpose:

Use this to process payments for Wages and Salaries, Bank interest and charges payable, Rent etc. – payments not relating to customers and suppliers’ invoices and credit notes.

Preparation:

Ensure cheque signatories are available (if applicable) or make payment through bank awaiting authorisation.

Ensure you have supporting documents to hand to answer any queries.

Obtain an up-to-date nominal code List – see List Chart of Accounts.

Processing:

On the main menu click Daybooks > Cash Book > Payments > Nominal Ledger.

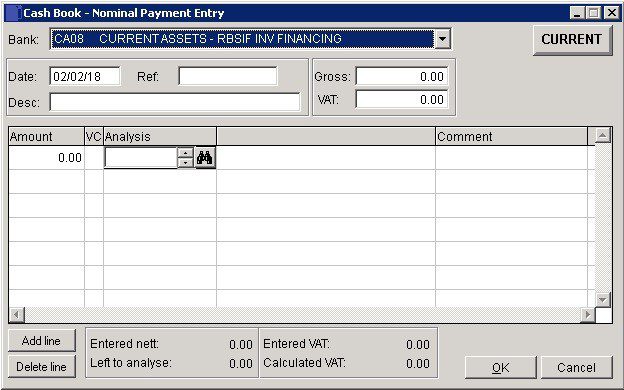

Process payment – see Cash Book – Nominal Payment Entry form – below.

Click OK to update.

Balancing/Reconciliation:

See Bank Reconciliation.

Reporting:

As required – see List Cash Book Transactions.

- Bank: Important! – Please select the bank account the payment was (is to be) made from.

- Date: Either: Manual entry formatted as DD/MM/YY. Type over the parts of the date you wish to change – the system will skip over the “/” part itself. If the date you enter is invalid; the cursor will return to the start of the date and await a valid entry, or; cick on the field to highlight data – white on a blue background – then right click to open the Calendar Menu – see Dates and Calendar.

- Reference: For cash book listing.

- Gross & VAT: Enter total amounts – usually monthly spend.

- Enter Net Amount and appropriate VAT Code and amount on each line until Left to analyse = nil and Entered VAT = Calculated VAT – differences can be adjusted.

- Click OK to post to nominal ledger or Cancel to abandon.

0 Comments