Post Purchase Credit Note

Purpose:

To post credit notes individually – for those not matched to a purchase order.

Preparation:

Decide whether you wish all purchase invoices and credit notes to have a sequential number – this is the default. If not go to Set Supplier Preferences and against Purchase order numbering method select Manual. If you do not wish to use the default we recommend you use the Supplier’s Invoice/ Credit Note number as the reference.

Processing:

Click on Suppliers > Post credit Note

Opens the Select Supplier form – see Edit Supplier to view form.

Select the supplier from the dropdown box or the cloud link list to open this form-

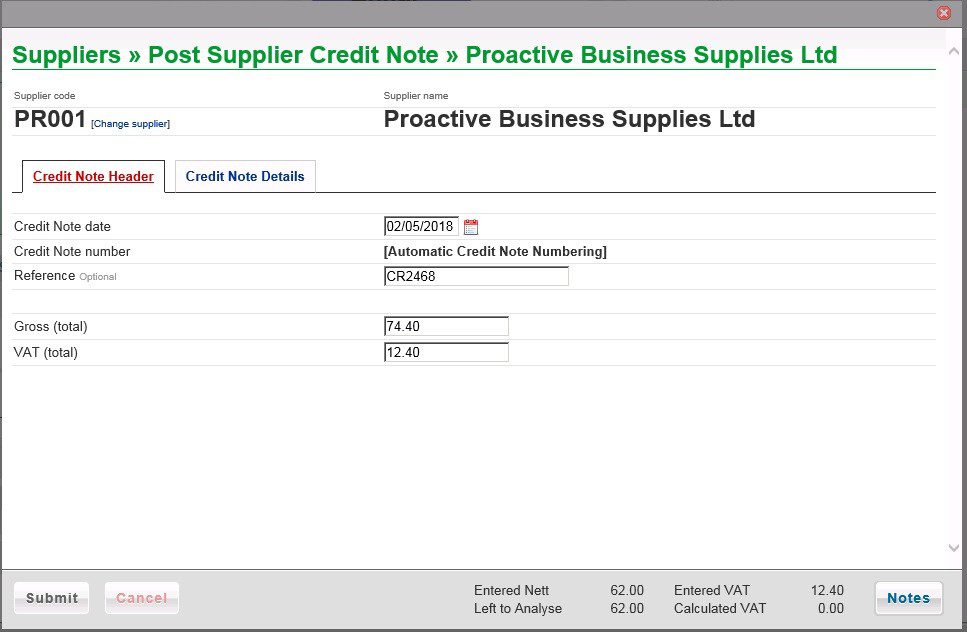

Purchase Credit Note Header

- Enter Date – see datepicker.

- See Preparation above before entering Invoice number/Reference.

- Enter total amount (Gross) from Credit Note.

- Note: You can change supplier if wrong one selected and add a new bank.

- Click on the Credit Note Details tab-

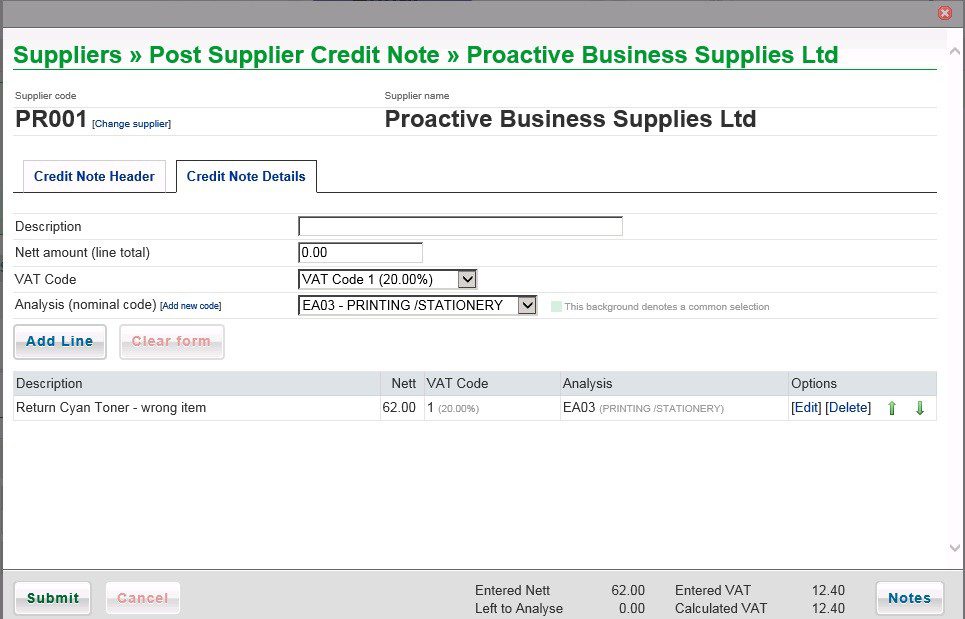

Purchase Credit Note Details

- Enter a Description for each line on the Credit Note.

- Enter Nett amount for the line, select VAT Code and Analysis Code.

- Click on Add Line to add to grid and update the Calculated VAT.

- Repeat until Left to analyse = nil and Entered VAT and Calculated VAT are the same – you may need to amend the VAT on a line – click on [Edit] on the appropriate line in the grid.

- You can also delete a line and re-enter if necessary.

- When done click on Submit to post the credit note to the ledgers.

- The Notes button allows you to update notes relating to the supplier.

- Note: you can create a new nominal code if necessary.

You can also post VAT only credit notes (corrections) as follows –

Enter the Gross amount on the header tab and the same amount into VAT. On the Credit Note Details tab leave the net amount as 0.00 Add Line and Submit.

0 Comments