Configure VAT Schemes

Purpose:

To configure how VAT is accounted for and reported or to disable it entirely.

If your business is not registered for VAT, select No and click Submit.

If your business is registered for VAT, select Yes and complete the remainder of this form. You will need knowledge of the VAT scheme in use by your business. Consult your accountant if you are unsure.

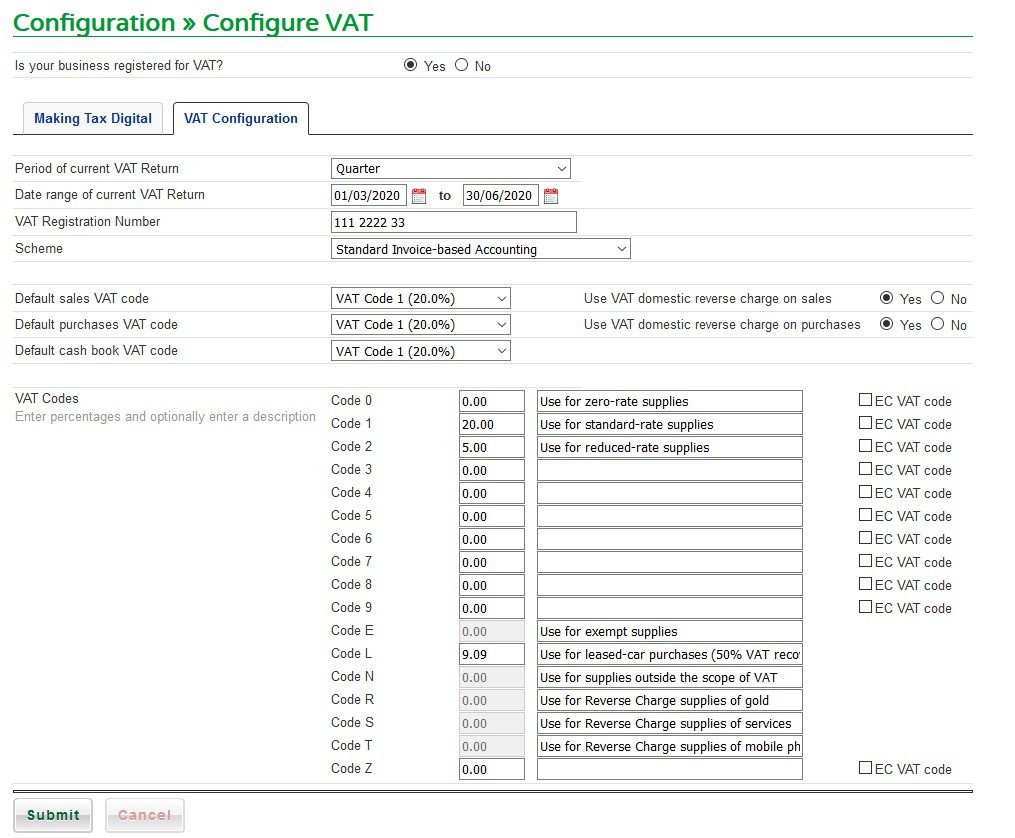

VAT Configuration

Date of Next Return: – The month-end, quarter-end or year-end date – not the due by date.

Select the appropriate VAT Period, then enter VAT Registration Number – Prefix with GB or appropriate country code. The VAT Period options are: Monthly, Quarterly, Annual and must be agreed with HMRC. For Annual VAT Returns, note that the reported amount is not the amount to pay as monthly instalments should have already been paid.

Select the appropriate VAT Scheme for your business. If unsure, ask your accountant.

Select Default sales VAT code – You can also set this in Customer preferences.

Use VAT domestic reverse charge on sales toggles with the setting in Customer preferences

Use VAT domestic reverse charge on purchases toggles with the setting in Supplier preferences

For more information on DRC VAT please refer to https://help.prelude.software/knowledge-base/domestic-reverse-charges-drc/

Select Default purchases VAT code – You can also set this in Supplier preferences. Prelude Desktop and Cloud use the Default purchases VAT code to report on EC aquisitions so please ensure it uses the standard rate.

Select Default cash book VAT code – for miscellaneous non-financial items such as sundry sales, purchases not entered in the suppliers ledger for which you receive a VAT invoice.

Manage VAT Codes – Which VAT Codes to use and how to use them will depend on your preference and on the nature of your business – e.g. whether you import and/or export or supply exempted goods or are registered with a particular scheme. If you are unsure you should consult your accountant. If a VAT Code’s description is not already populated for you, or if you want to change it, type a relevant description for that VAT Code. If you want to use a VAT Code to account for EC supplies, sales and/or purchases, tick the relevant ‘EC VAT Code’ check box. Please note the rule changes post-Brexit – See https://help.prelude.software/knowledge-base/postponed-vat-accounting-pva/

When complete – click Submit – You can come back to this later if necessary.

How to use the VAT Codes and the available VAT Schemes

Generally, for all schemes, day-to-day transactions should be accounted for as per the standard schemes using VAT Codes 0, 1, 2, E, N as appropriate. Depending on the selected VAT Scheme, other VAT Codes will be enabled for the special purposes of that scheme.

We suggest that you use VAT Code L to account for leased-car purchases. With this code’s VAT rate set at 50% of the prevailing standard VAT rate, the appropriate recovery of only 50% of the input VAT will be taken care of. However, you don’t have to do it this way.

Note: 9.09% is the rate needed to calculate the VAT correctly. Example: Lease Charge £200 + VAT of £40. Adjusted for recoverable to be entered into the ledger is a lease charge of £220 and VAT of £20. The VAT element is 1/11th of the Nett figure = 9.09%.

Standard Invoice-based accounting

Transactions will be reported as they have been accounted for, based on the invoice date.

Standard Cash-based Accounting

Transactions will be reported as they have been accounted for, based on the receipt or payment date and/or matching date.

Flat Rate Invoice-based Accounting

Transactions posted with the standard VAT Codes (e.g. 0, 1, 2, ) will be recalculated using the scheme’s percentage rate and based on the invoice date, with adjusting journals posted automatically to effect the resulting changes to profit and VAT liability.

Flat Rate Cash-based Accounting

As above, but based on payment date and/or matching date.

Codes R, S and T are reserved for Reverse Charge schemes. See the article in the Making Tax Digital section.

There are other special schemes not listed here, which may be catered for should the need arise.

0 Comments