Standard Adjustment Journals

Standard Journals

The majority of day-to-day business transactions can be processed through the Daybooks menus explained in the Sales, Purchases and Cash Book sections.

For more complex transactions and accounting adjustments, e.g. Post Payroll, Accruals and Prepayments using Reversing Journals and accounting corrections, Nominal Ledger journals are required.

Nominal, Sales and Purchase Ledger adjustments, or journals, can all be entered using a single form called the Journal Entry form.

All three ledgers can be adjusted in a single journal. Prelude desktop also allows the creation and posting of Reversing Journals.

Purpose:

Other systems use a different process for adjusting each of the ledgers independently. Prelude products allow you to use the same Standard Journal Entry form to:

Adjust records in each or any combination of Sales, Purchase and Nominal Ledgers after they have been updated by posting correcting entries and/or posting data generated outside the system into the ledgers – e.g. depreciation (unless you have and use the Fixed Asset module), amortisation, HP Interest and other accounting adjustments.

Different types of adjustment:

We all make mistakes and, if we didn’t, we would never learn anything. We recommend that first time users read A Rough Guide to Bookkeeping and post some journal entries using dummy data in a test company before posting live data.

Ledger Adjustments are needed to:

Correct Errors of Principle – A debit entry was posted instead of a credit entry or vice versa. In the example below, a user has posted a supplier credit note with a gross value of GBP £120.00 as if it were an invoice.

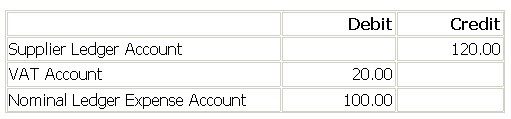

The system has recorded the following entries for this transaction:

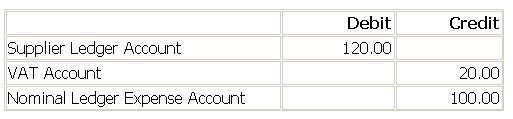

The entry should have been:

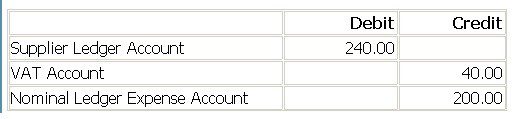

In order to correct this, you will need to double the value of the entries made – if you merely debit the ledger account with 120.00 you will make the net balance for this transaction zero – it will be as if the transaction were never posted at all. The correcting entry is therefore:

Correct Errors of Amount – these are single value entries to be posted as corrections. A user could, for example, make a transposition errror – instead of a purchase invoice value £72.00 they posted an amount of £27.00 (If the error amount is divisible by 9, it is most likely a transposition error). In this case the journal entry will show a debit and credit entry of £45.00.

Correct mispostings – an entry has been made to the wrong nominal, purchase or sales ledger account. For example, a supplier invoice with a net value of £100.00 has been posted as a debit to the motor expense account in the nominal ledger. The entry should have been made into the stationery expense account. If postings are made to the wrong sales or purchase account an opposite entry need to be made to clear it and then re-enter into the right account. If an invoice is misposted create a credit note posting and vice versa. see also Re-Enter an Existing Produced Sales Invoice and Re-enter Posted Invoice

Post data generated outside the system

see below for payroll data processed using another system into the nominal ledger.

also see Journals – Opening Balances for opening balances and prior year adjustments.

Important note:

If adjusting Sales and Purchase Ledgers ensure that these are in the same period as the Nominal Ledger.

Processing:

Prelude desktop – On the main menu click Ledgers > Nominal > Journals > Standard

or click the “Post Nominal Ledger Journals” control button on the toolbar to open the form – see Configure Toolbar.

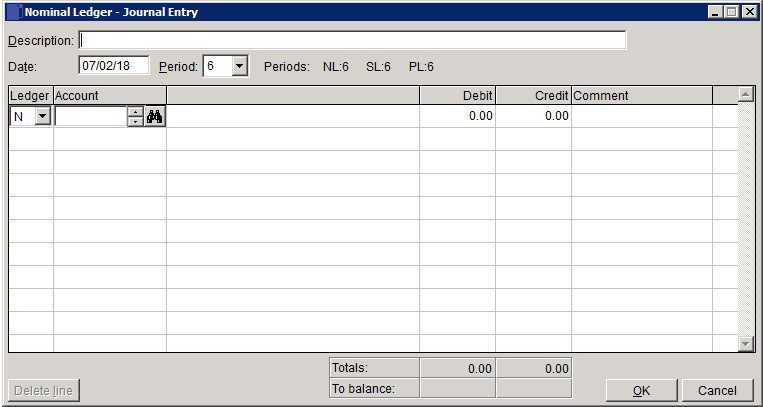

Enter data as required – see Nominal Ledger – Journal Entry form below.

Ensure ‘To balance‘ field is zero.

OK to post, Cancel to close form without posting.

Print as required – see Printing Reports, OR save as a.pdf in a regularly backed up folder.

Match Purchase and Sales Ledger posted journal entries to tidy the accounts – see Match Sales or Purchase Ledger Transactions.

Filing:

File copies as required OR save as a.pdf in a regularly backed up folder. The appropriate manager should authorise journals for large amounts.

- Description: Mandatory – enter brief explanation for the adjustment.

- Date: Enter the appropriate date or accept default accounting date – Many journals are posted after the period end and it is usual to date these as the last day of the period.

- Ledger: Select S for Sales Ledger adjustment, P or Purchase Ledger or accept default of N -Nominal ledger.

- Select Account and Cost Centre ( Nominal only – if activated).

- Debit, Credit: Enter either Debit amount or Credit amount for each line – a line cannot contain both.

- Comment: Brief notes to be displayed in the nominal ledger against this entry.

- Delete Line: Highlight line and click on Delete.

- Totals: The sum of all entries in each of the Debit and Credit columns – these must be the same before the journal can be posted.

- To Balance: Must be zero before records are updated.

- OK: Updates records and displays transaction number of journal. Message box, click Yes to print, No to close print form. If Yes – select required output for report.

- Cancel: Display warning message box – click Yes to close form without update, No to return to form.

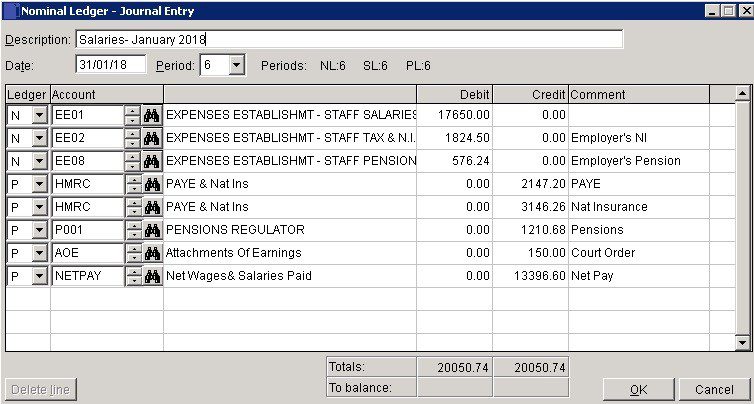

Example of one way of creating Payroll Journals.

Payroll

Creating and using Purchase Ledger Accounts for payroll deductions is a useful way of ensuring that these large liabilities are tracked and visible. Journals should be posted as soon as possible after weekly and/or monthly payroll has been processed. With the advent of RTI it may be that you have set up a Direct Debit with HMRC and postings can be made through a recurring journal – see Post Journal Entries Automatically.

At any time, the balances on the Purchase Ledger Accounts described will equal amounts owed to the Inland Revenue and will be included in the figures shown on the At-a-Glance Form – see At-A-Glance. If the transactions are not posted through the purchase ledger the liability will not appear in the At-a-Glance Form.

Create purchase ledger accounts for HMRC – PAYE & NI, Pensions,other deductions to be paid over to a third party – e.g. Attachments of Earnings and Net Pay. Wages & Salaries costs will be posted to the nominal ledger. A journal would look like this:

All the payroll related accounts can alternatively be set up in the nominal ledger but the At- A- Glance figures will not include the liability. if using the purchase ledger method, at the year end, you will need to adjust the liability from Trade Creditors to Taxation – your accountant will probably do this for you.

0 Comments