Cash Book – Post VAT Refunds

Purpose: To distinguish from all other receipts so that the amount is not included in the VAT Return.

If you are V.A.T. registered and, for your V.A.T. reporting period, the amount of V.A.T. you have paid on your purchases exceeds the amount of V.A.T. you have charged on your sales, then you will be entitled to a refund of V.A.T. for that V.A.T. reporting period

Processing:

On the main menu click Daybooks > Cash Book > Receipts > V.A.T. Refund.

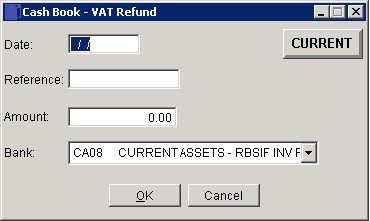

Process refund – see Cashbook – VAT Refund form – below

Click OK to update.

Balancing/Reconciliation:

Refund should equal the V.A.T. amount on the latest VAT return and be reconcilable to the balance in the nominal ledger to the end of the period to which the VAT return relates – see How Do I Reconcile My VAT Return?

Reporting:

As required – see List Cash Book Transactions.

Filing:

File any supporting documents with V.A.T. records.

- Date: Either: Manual entry formatted as DD/MM/YY. Type over the parts of the date you wish to change – the system will skip over the “/” part itself. If the date you enter is invalid; the cursor will return to the start of the date and await a valid entry, or; click on the field to highlight data – white on a blue background – then right click to open the Calendar Menu – see Dates and Calendar.

- Bank: Important! – Select the Bank Account into which the amount was received.

- Click OK to post to ledger or Cancel to abandon.

0 Comments