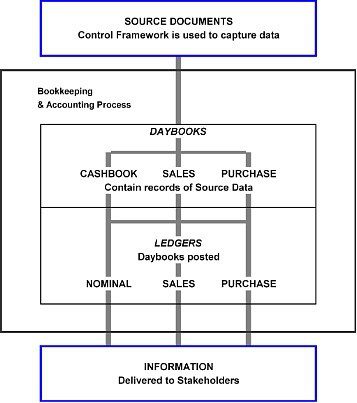

Bookkeeping And Accounting Process

In the normal course of business, a Source Document is produced each time a transaction occurs. As an example, when goods are despatched Sales Invoices are produced and sent to Customers. The Bookkeeping Process starts with Source Documents being recorded into a Book of Prime Entry or Daybook – refer to Produce Sales Invoices for an example of how a Daybook works in Prelude .

In Prelude,daybook entries are then transferred to accounts in a ledger – a task called Posting. As an example, a sales invoice for goods despatched to a customer will be recorded in that customer’s account in the sales ledger, and also in the VAT and income account(s) in the nominal ledger – see Post Sales Invoices to the Ledger.

Once all transactions have been posted, the entries in each ledger account are added up to give a total value which is the Balance on that account.

A Trial Balance can now be printed which lists all the balances at the date of the trial balance (e.g. month end date) from all the ledger accounts in the nominal ledger. The amounts are displayed in a two-column list with debit balance amounts recorded in the left column and credit balance amounts recorded in the right column – see Print or Display a Trial Balance.

The Accounting Process begins with a review of the Trial Balance to ensure that account balances comply with accounting principles. Any necessary adjustments to balances can be made using Journal Entries – see Make Nominal Ledger Adjustments. This process continues until the resulting figures are correct.

Financial statements can be prepared from the trial balance, which may include one or more of the following:

A Profit and Loss Account, or simply P & L,

A Balance Sheet,

A Cash Flow Statement – if required,

Management Information as required.

The Financial Statements are then available for use by one or more of the following:

Management and Shareholders

Banks and other Lenders,

Suppliers – for assessing credit terms.

The diagram below shows how Daybooks and Ledgers are linked in Prelude

Invoices and Credit Notes

Throughout the help file you will see references to invoices and credit notes. It is useful to define these so that you can put such information into context.

An Invoice is a commercial document in a form consistent with the trade identifying both buyer and seller, reflecting the price actually paid or payable, the terms of sale, the currency used for payment, the articles sold, and other specific information required for duty assessment purposes. A Credit Note is a monetary instrument issued by a seller that allows a buyer to purchase an item or service from that seller on a future date. Credit notes may be issued by a seller as a goodwill gesture to a buyer who wishes to return previously purchased merchandise (instead of cash repayment) in circumstances where the original sales agreement did not include an explicit refund policy for returned items. In such circumstances, a credit note of value equal to the price of the returned item is usually issued allowing the buyer to exchange his purchase for other items available with the sale.

0 Comments