Assets – Post Period Depreciation

Purpose:

The system will automatically calculate and post depreciation for all assets that are not fully depreciated or which have not been sold in this or prior periods as part of the Nominal Ledger month and year end routines – see Period End Processing.

Preparation:

Ensure all Fixed Assets Additions, Disposals and Revaluations have been entered onto the asset register before running the nominal ledger month end routines.

Once this is done, run the period end depreciation routine to automatically post the correct depreciation amounts to the balance sheet and P & L codes shown as part of each asset record.

Processing:

On the main menu click Fixed Assets > Run Depreciation.

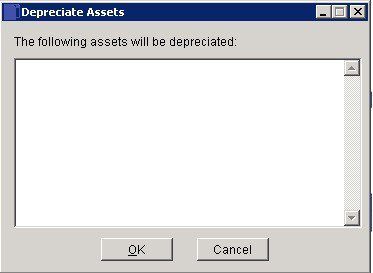

Depreciate Assets form opens listing the assets to be depreciated.

Review list and make any changes to asset details required – see Assets – Create and Edit .

Click OK or Close to exit form.

Balancing/Reconciliation:

Reconcile Nominal Account Depreciation Balances to Asset Register. Action any differences – usually caused by either miscoding or omitting the depreciation nominal codes in Fixed Asset Maintenance – check those added in the last month.

0 Comments