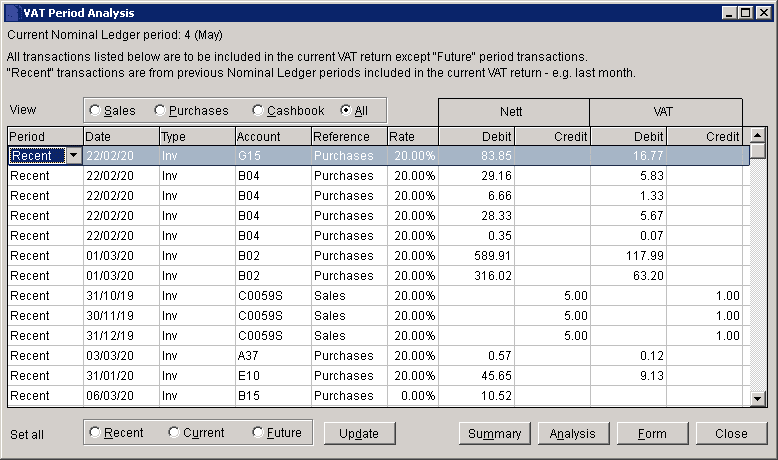

VAT Period Analysis

Purpose:

To view and manipulate the detailed transaction entries that populate the VAT reports, which in turn populate the summary VAT Return that is submitted to HMRC. Future-period entries can be brought into the recent/current periods, thereby including them in the current VAT Return; and conversely recent/current-period entries can be moved to the future period, thereby potentially deferring them to the next VAT Return. This can be useful if, for example, the sales and/or purchase ledger periods have been closed and late-posted entries need to be included in the current VAT return. Entries cannot be edited or deleted.

- Recent is any past accounting period that is still included in the current VAT Return

- Current is the current accounting period, which is included in the current VAT Return

- Future is a future accounting period, which may not included in the current VAT Return

Process:

This should be the first step in preparing the current VAT Return. Also view this form periodically to check for errors and omissions.

On the main menu, click Ledgers > Nominal > VAT Period Analysis.

Essentially this is a form view of the VAT Input/Output analysis reports and will be up to date with the latest tranasctions that were processed.

To filter the entries that are displayed in the grid:

- View radio buttons filter all entries to show only sales, purchases, cash book or all, as required.

- Each column heading can be clicked to display detailed filter options.

To change the period of the displayed entries:

- Change the period of individual entries by changing the selected period (Recent, Current, Future) in the Period column.

- Clicking one of the Set all radio buttons will change the period of all the displayed entries in the grid, so take care. Only the displayed entries are affected, so filters can be used to exclude some entries before using Set all.

- When all changes have been made, click Update to commit them to the database. This cannot be undone, so take care.

- Changes are not committed to the database until Update is clicked, so click Close at any time to abort.

This can be repetaed any number of times. For example, edit Sales entries first, then Purchases, then Cash book.

To view VAT reports and the VAT Form, from which to proceed to submit the VAT Return:

- Click Summary to view the VAT Summary report.

- Click Analysis to view the VAT Input/Output Analysis report.

- Click Form to view the VAT Form, from which the VAT Return can be submitted.

Click Close at any time to close the form. Unsaved changes will be lost.

0 Comments