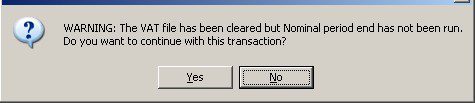

Warning – Transactions After Cleared VAT File

Appears during Daybook transactions.

Because… The system recognises that the VAT file has been cleared in order to close VAT reporting for the period but the Nominal End of Period has not yet been run.

Therefore… If the current Nominal Period is a VAT reporting period, it means that VAT on daybook transactions subsequently entered before the Nominal End of Period is run, will not show in the daybooks for the periods relating to the next VAT return and may make the VAT reconciliation more difficult. However it may be ncessary to include the transaction in order to include the amount in your management reports.

Actions … Either click No and run the the Nominal End of Period (the transaction will then appear on the next quarter’s VAT return).

Or click Yes and re-run the VAT summary and Input/Output reports immediately before running your period end, in order to assist with the VAT reconciliation.

0 Comments