Using VAT Filer

Use VAT Filer to submit MTD VAT Returns from our Desktop Accounting application or from data you can import or enter manually. A fee may be charged for using this service.

Create a VAT Filer database and log in at https://my.prelude.software/vatsubmit

Your VAT Filer database ID must be your VAT Registered Number, which will be verified before you can proceed.

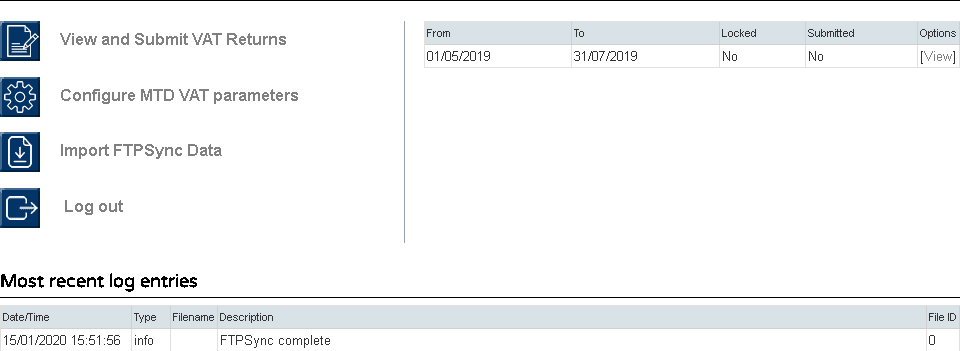

When you log in you will be presented with the Dashboard:

- View and Submit VAT Returns: Click to go to the VAT Return page ready for the current VAT Return.

- Behaviour is the same as for Cloud Accounting, which is documented here (opens in a new tab).

- With one addition, which is the ‘Include future dated’ checkbox in the period selector header. Depending on the source data, this might have to be checked in order to include source-data records whose date is after the period end date.

- Configure VAT Parameters: Click to go to the VAT Parameters page.

- Behaviour is the same as for Cloud Accounting, which is documented here and here ( each opens in a new tab).

- Import FTPSync Data: This applies to our Desktop Accounting application or other software by special arrangement. Click to re-run the data import routine on occasions when the automatic schedule has failed or must be run manually. Normally this won’t be required.

- Log out: Click to, erm, log out.

- VAT Returns List: This is a list of current and past VAT Returns. Click a [View] to go to the VAT Return page populated with the details of that VAT Return.

- Most recent log entries: This is a list of entries from the system log file, which can help with troubleshooting.