Standard Journal

A standard journal is used to correct errors and to post transactions created outside of the system.

The majority of day-to-day business transactions can be processed through the various menus explained in the Customers,Suppliers and Banking sections.

For more complex transactions and accounting adjustments, e.g. posting Payroll, Accruals and Prepayments using Reversing Journals and accounting corrections, Nominal Ledger journals are required.

To correct errors

- Correct Errors of Principle – A debit entry was posted instead of a credit entry or vice versa. In the example below, a user has posted a supplier credit note with a gross value of £120.00 as if it were an invoice.

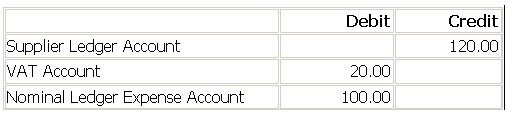

The system has recorded the following entries for this transaction:

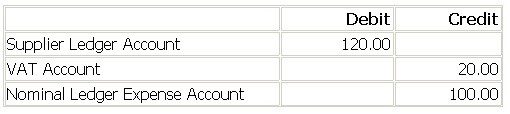

The entry should have been:

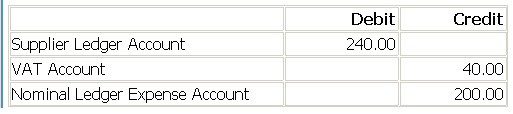

In order to correct this, you will need to double the value of the entries made – if you merely debit the Ledger account with £120.00 you will make the net balance for this transaction zero – it will be as if the transaction were never posted at all. The correcting entry is therefore:

2. Correct Errors of Amount – these are single value entries to be posted as corrections. A user could, for example, make a Transposition Error – instead of a purchase invoice value £72.00 they posted an invoice value of £27.00 (If the error amount is divisible by 9, it is most likely a transposition error). In this case the journal entry will show a debit and credit entry of £ 45.00.

3. Correct Mispostings – an entry has been made to the wrong nominal account. For example, a supplier Invoice with a nett value of £100.00 has been posted as a debit to the motor expense account in the nominal ledger. The entry should have been made into the stationery expense account. For this a debit entry to stationery and a credit to motor expenses is required to correct.

4. To post entries created outside of the system – Here are some examples:

Payroll

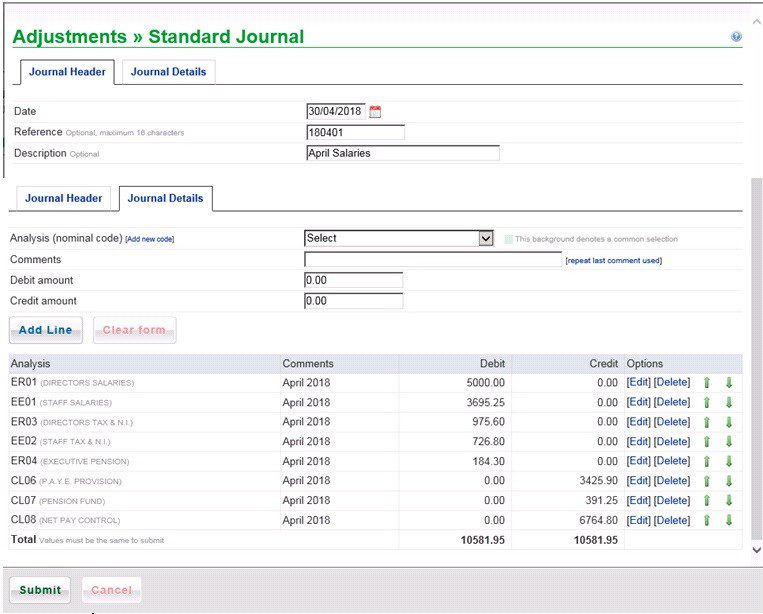

Journal header

This is a typical payroll journal – the date is the month end – changed from today’s date – enter manually or use Datepicker.

Enter Reference – I have used 18 =year + 04 = month + 01 = journal number in month – makes for easy filing and finding – but use whatever you wish.

Enter Comment – I have used April 2018 throughout (click on repeat last comment used)- when I look at the reports I know what it relates to.

The journal must balance before posting – Total Debits = Total Credits.

Until posted (by clicking on Submit) you can [Edit] or [Delete] any line.

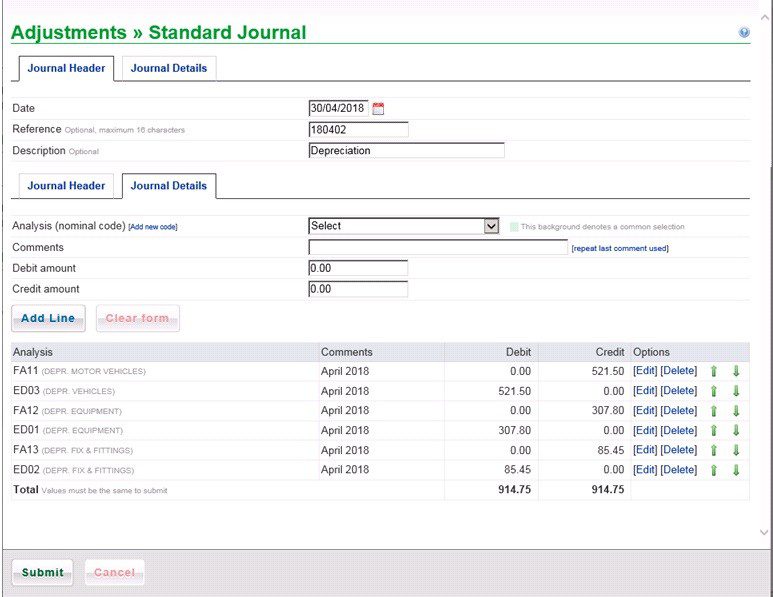

Depreciation

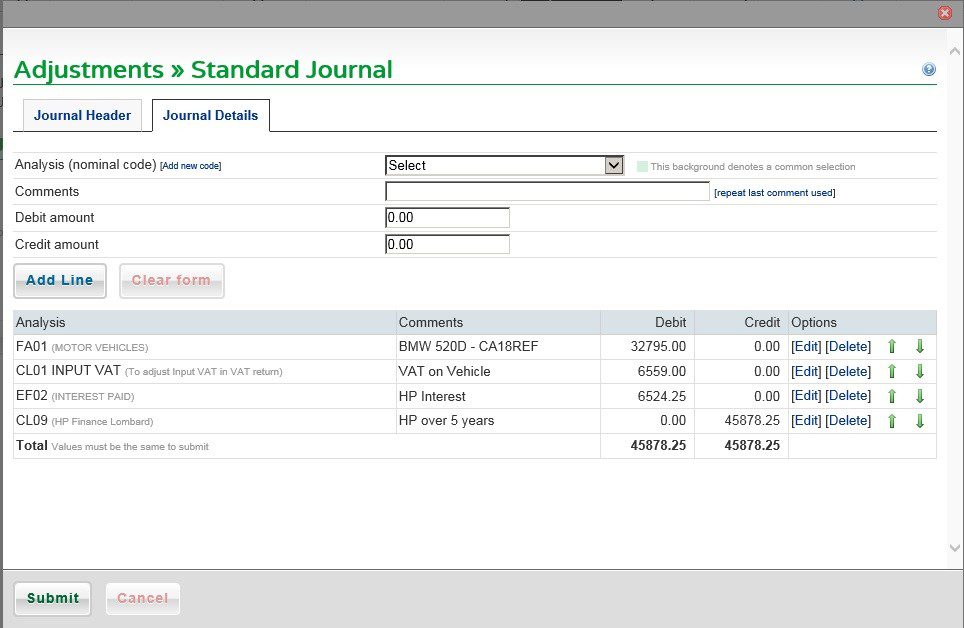

The following journal demonstrates a car purchase with VAT involved – you can choose whether the VAT amount is an Input or Output VAT adjustment – this will be reflected in the VAT return.

Opening balances are also processed using journals – before starting, read up on ‘How to post Opening Balances‘

As Prelude is date based, prior – year journals are processed with the last date of the previous year with profit and loss items being posted to the reserve account – consult your accountant, if in doubt.

0 Comments