Purchase Ledger – Post Credit Notes

Purpose:

Uuse to post supplier credit notes to Purchase and Nominal ledgers.

Preparation:

The following list of possible preparation steps will help you decide if you need to do anything before processing and if you need help.

Select a company – see Change Companies.

Obtain an up-to-date supplier list – see Supplier Listing.

Obtain an up-to-date nominal code list – see List Chart of Accounts.

Ensure supplier details are up to date – see Create & Edit Supplier Accounts.

Set the default transaction date as required – see Change Accounting Date.

Processing:

On the main menu click Daybooks > Purchase Daybook > Post Credit Notes, or;

On the main menu View > Configure Toolbar – open form – see Configure Toolbar.

Check the box to the left of Post Purchase Credit Notes.

Click Apply button to display the control button –

click the control button to open form – see Purchase Daybook Post Credit Notes form below.

Either: Select required supplier, or type in a new account number then click Yes on the message box to create a new account – see Add Supplier Account Form – remember to enter the supplier’s full details as soon as possible – see Create & Edit Supplier Accounts.

Post the credit note nett of VAT amount to individual Nominal Ledger Codes line by line using the mouse or tab keys to navigate along lines and Return to accept the entries and move to the next line.

Click OK to accept and update records.

Alternatively, many credit notes may be posted at once – use Daybooks > Purchase Daybook > Batch Posting.

Balancing/Reconciliation:

Export or print Daybook Listing and ensure all credit notes have been posted.

Periodically reconcile Purchase Ledger Account entries to supplier statements and investigate and resolve any differences. Note any issues on Ledger Account Notes.

Filing:

Write the entered/system generated document number on the credit note. File in document number or alphabetical order. File copy of Daybook Listing with documents.

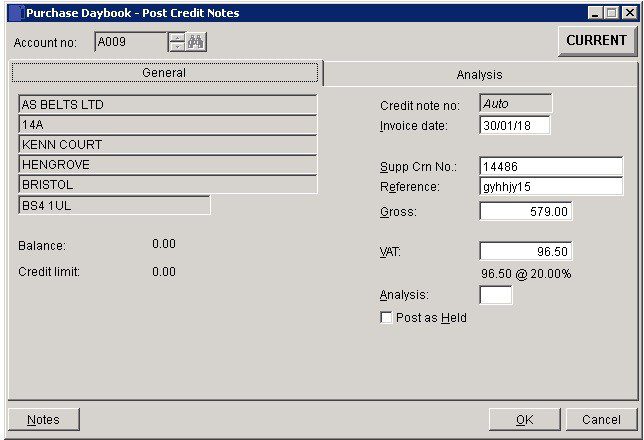

- Credit Note No: Enter credit note reference number or click for next system number.

- Date: Either: manual entry formatted as DD/MM/YY. Type over the parts of the date you wish to change – the system will skip over the “/” part itself. If the date you enter is invalid; the cursor will return to the start of the date and await a valid entry, or;

- Click on the field to highlight data – white on a blue background – then Right Click to open the calendar menu – see Dates and Calendar.

- Reference: Up to 16 characters.

- Gross & VAT: Enter total credit note amount, the system will calculate the VAT amount for you to check and amend, if necessary.

- Analysis: Maximum 2 characters account specific – customers can be grouped together for reporting. Defaults to code shown on ledger account – see Purchases analysis.

- Notes: Add notes to the supplier account if required.

- Post as Held: Check to hold credit note until authorised – prevents payment until released.

- Click ‘OK’ to accept entry and open analysis or ‘Cancel’ to abandon.

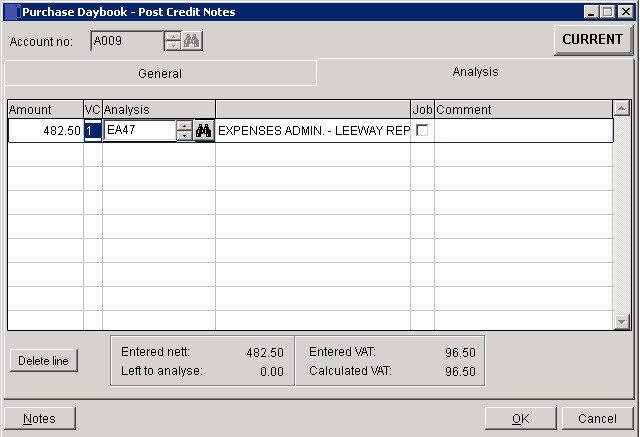

- Amount: Nett amounts to to be posted to nominal ledger to any number of codes The aggregate total and the balance to analyse are shown at the bottom of the form.

- VC: The VAT Code applicable to the net amount entered.

- Comment: to appear in the nominal ledger against that line posting.

- Entered VAT and Calculated VAT must match and Left to analyse must be nil. You can adjust the figures until this is so.

- Click OK to make postings to purchase and nominal ledgers and clear – click Cancel to abandon.

0 Comments