Sales Ledger

Purpose: To configure the settings so that the Sales Ledger gives the business the information it needs to perform effective when trading with customers. The parameters form consists of three settings pages and three messages for use with Sales Statements.

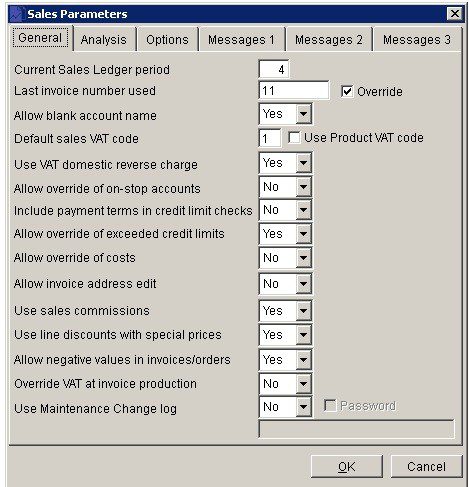

General Page

- Current Period: Enter a number from 1 to 12 corresponding to the current Nominal Ledger period; keeping in mind the Period Rule (see Period End Processing). This should only be changed when there are no transactions in the system, such as when setting up a new company.

- Last invoice number: Enter the last invoice or credit note number used before transferring your business to your new product. Once set this will be automatically incremented by the system each time an invoice or credit note is created.

- Check the Override Box to allow this to be overwritten when creating Invoices, Credit Notes and Documents.

- VAT Code: Enter the VAT code corresponding to the most commonly used VAT rate used on Sales Invoices, Credit Notes or Orders – see VAT & Bank Details Page.

- Use VAT domestic reverse charge – select yes it it applies.

- On Stop: Select Yes to allow user to create an order or produce or post an Invoice or Credit Note whilst a customer account in on stop – see Put a Customer on ‘Stop’.

- Include payment terms: Show user payment terms when notifying that the account is over it’s credit limit.

- Credit Limit: Select Yes to allow user to create an order or produce or post an invoice or credit note whilst a customer account balance exceeds their Credit limit.

- Costs: Select Yes to override the cost of product items, or enter a cost for non-product items, which will be used to calculate the margins in the sales analysis reports.

- Invoice Address: Select Yes to amend the invoice address at the time of invoicing. This address will then apply to each invoice but will not affect the name and address set up in the ledger.

- Commissions: Select Yes to calculate Sales Commissions for Sales Reps.

- Discounts: Select Yes to allow line discounts to be entered on Sales Documents when Special Selling Prices are used.

- Negatives: Select Yes to allow negative values to be entered on Sales Documents.

- VAT: Select Yes to allow manual override of the system-calculated total VAT amount on the invoice. This feature is disabled if VAT-inclusive pricing is activated.

- Click ‘OK’ to save or ‘Cancel‘ to clear and close without saving.

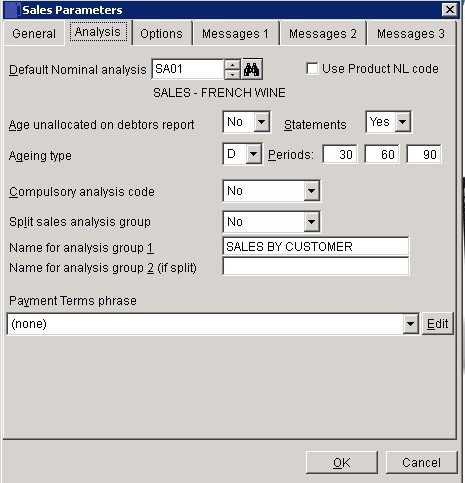

Analysis Page

- Nominal Analysis: Unless otherwise specified, the net value of an Invoice or Credit Note will be posted to this Nominal Code. Tick ‘Use Product NL Code‘ if using Stock Control with defined nominal analysis codes.

- Unallocated: Unallocated cash will be shown as a single column on the Aged Debtors listing, Click Yes to age as outstanding amounts.

- Ageing Type: The ageing of a transaction, be it an invoice, payment, etc., is based on the amount of time that has passed between the transaction’s date and the default transaction date. For reporting purposes, this time is grouped into three periods, and the amount of the transaction is then classed as ‘Current’ – not older than period 1, ‘Over period 1‘ – but less than period 2, ‘Over period 2‘ – but less than period 3, and ‘Over period 3‘. The amount of time within these periods is specified in the Periods field.

Select ‘D’ for days, ‘M’ for months or ‘C’ for calendar months or ‘E’ for end of month from the Drop Down Box

This then applies to all three periods. Each period may then have its own amount of time which does not have to be a multiple of any other period but must be greater than the prior period and less than the next.

D Period days from transaction date

e.g. transaction date = 23/09/2018, Period = 0, Due date = 23/09/2018

e.g. transaction date = 23/09/2018, Period = 15, Due date = 08/10/2018

e.g. transaction date = 23/09/2018, Period = 30, Due date = 23/10/2018

E Period days from end-of-month of transaction date

e.g. transaction date = 23/09/2018, Period = 0, Due date = 30/09/2018

e.g. transaction date = 23/09/2018, Period = 15, Due date = 15/10/2018

e.g. transaction date = 23/09/2018, Period = 30, Due date = 30/10/2018 M Period months from transaction date, or last day of the month if the calculated date doesn’t exist

e.g. transaction date = 23/09/2018, Period = 0, Due date = 23/09/2018

e.g. transaction date = 23/09/2018, Period = 1, Due date = 23/10/2018

e.g. transaction date = 23/09/2018, Period = 2, Due date = 23/11/2018

C Period end-of-months from end-of-month of transaction date

e.g. transaction date = 23/09/2018, Period = 0, Due date = 30/09/2018

e.g. transaction date = 23/09/2018, Period = 1, Due date = 30/10/2018

e.g. transaction date = 23/09/2018, Period = 2, Due date = 30/11/2018

- Compulsory Analysis: Yes to require a two character analysis code to be entered when processing Sales Invoices, Credit Notes or Orders.

- Split: Yes to make leftmost character of the analysis code as the main group (group 1) and the rightmost character defines sub-groups (group 2) within group 1. This allows you to set up a more complex report.

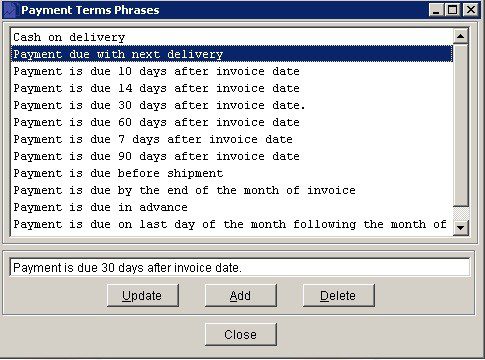

- Payment terms phrase: Click on the down arrow to select the phrase you wish to use. You can edit the phrases to suit your own needs –

- Update: Select a phrase you wish to alter and this will appear in the edit line – amend as appropriate and click update.

- Add: Either type into the empty edit line or amend a current entry and click on add – the current entry will remain unchanged.

- Delete: Select the entry you wish to delete and click to delete.

The selected phrase will be the default that appears on statements and invoices – see Stationery Design to add to statements and invoices.

Click ‘OK’ to save or ‘Cancel‘ to clear and close without saving.

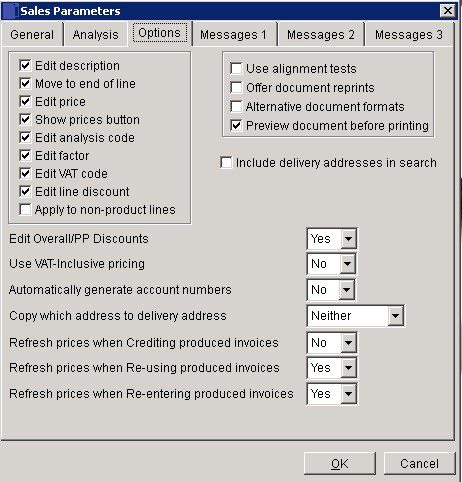

Options Page

- Edit Description — > Apply to non-Product Lines: Check to activate these fields in transaction production forms to allow the user to select and enter to them at transaction time. Uncheck to deactivate these fields in transaction forms. The field contents will be visible to the user at transaction time but not editable.

- Apply to non-product lines relates to all items above for non-product items.

- This can help security and data entry speed as the user can – and only has to – edit or tab through appropriate fields at transaction time.

- Alignment Tests: Check to print dummy Invoices/Credit Notes on the printer to check Multiple Form stationery alignment – you will be prompted to do this before you start to produce Sales Invoices or Credit Notes.

- Reprints: Check to allow more than one copy of an Invoices/Credit Note to be printed – you will be prompted to do this after you have produced Sales Invoices or Credit Notes.

- Alt. Formats: Check to allow user to select an alternative document format when you produce a Sales Invoice or Credit Note.

- Search: To display customer delivery addresses as part of a search result.

- Discounts: Yes to allow user to overwrite a customer’s default overall and prompt payment discounts when producing a Sales Document.

- VAT Inclusive: Yes to use VAT inclusive pricing when producing Sales Documents. The amount of VAT will be automatically calculated using the default VAT code for each line item entered and each relevant form will display ‘VAT Inclusive‘ as part of the heading.

- Account Nos: Yes to display new button on Sales Invoice Production Form. Click to open Add Customer Account Form. The new customer ledger account number will be automatically generated as the next number in the sequence.

- Click ‘OK’ to save or ‘Cancel‘ to clear and close without saving.

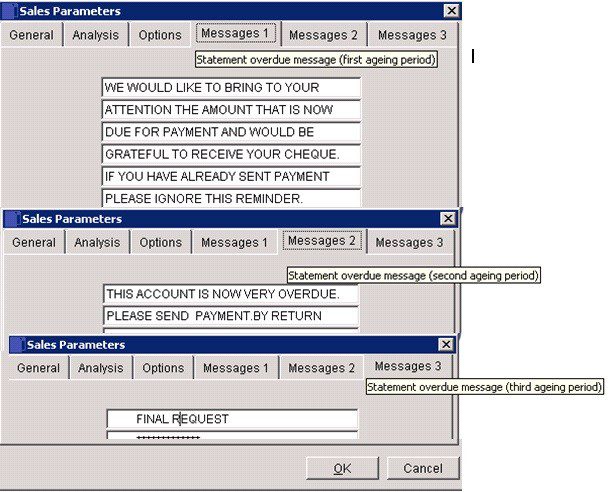

Messages Pages

Use to enter or amend the warning text that will be printed on the bottom of each Customer statement provided the ‘Include warnings?‘ box is checked on the Miscellaneous Page of the Sales Ledger Accounts Maintenance Form see Create & Edit Customer Accounts.

Message 1 is printed if the oldest open amount is 30 days or more but less than 60 days overdue. Message 2 is printed if the oldest amount is between 60 and 90 days overdue. Message 3 will appear statements whose oldest amount is 90 days or more overdue.

The above assumes that the ‘Ageing Type’ is ‘D’ for days and that the periods are 30, 60 and 90. The heading for each warning text, e.g. ‘Over 30 days’, changes to reflect the ageing parameters and may be different on your system.

You will need to update the Statement design in Stationery Design to include the 6 lines of warning. Click ‘OK’ to save or ‘Cancel‘ to clear and close without saving.

0 Comments