VAT Summary Report

Purpose:

The format of the report has been designed to help you complete your VAT Returns.

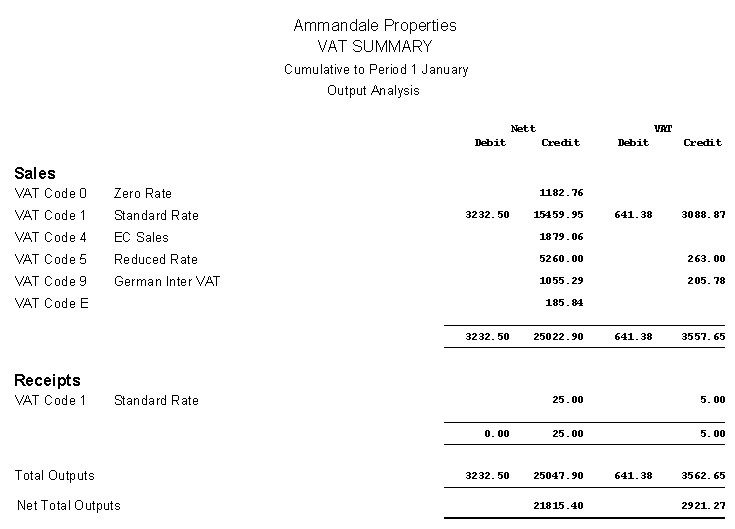

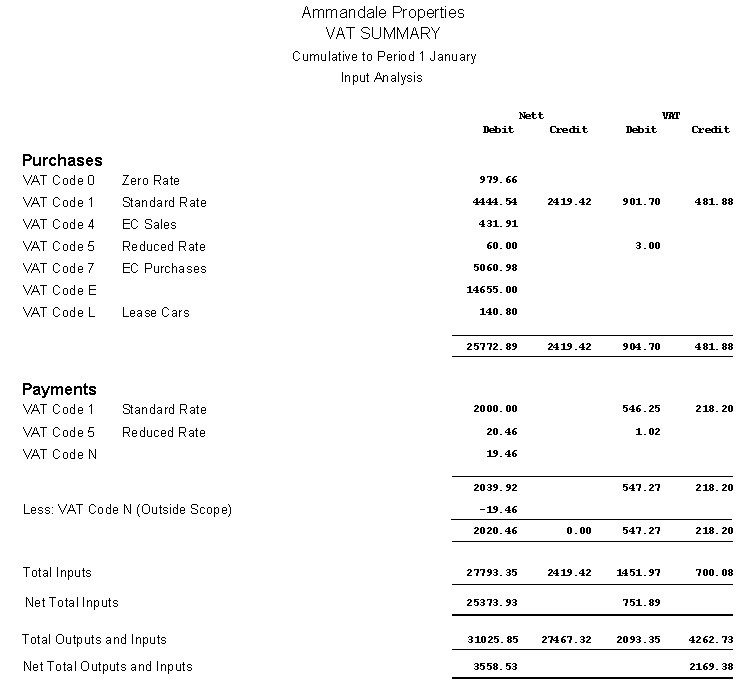

Produces a summary of Input and Output VAT by VAT code either for the current period or cumulatively since the VAT file was last cleared down analysed by daybook source and VAT code. The report also shows a total for any journal entries made to the VAT control account.

Print this each month and/or quarterly (cumulative)as part of End of Period process before closing the Nominal Ledger period – or save as .pdf in a regularly backed up folder.

Print as required to prepare a VAT return.

Print/display as required for reconciliation with VAT control account.

Preparation:

Ensure all the current transaction period’s data has been processed.

Ensure sales and purchase ledger period ends have been run – see Period End Processing

Processing:

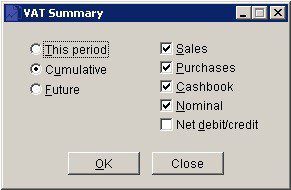

Either: On the main menu click Ledgers > Nominal > Standard Reports > VAT Summary, or Click Report button – Nominal Page – VAT Summary to open form.

Select parameters – see VAT Summary form – below

Select printer – see Printing Reports.

Click OK to print/display/export to selected file type.

Close form.

Balancing/Reconciliation:

Reconcile report balance to VAT Control Account balance. Investigate and amend differences and include entries on VAT return as appropriate. See FAQ – How Do I reconcile my VAT Account.

Filing:

File with month end working papers and/or VAT return workings.

Select One option from the radio buttons.

Check Net debit/credit to not show both – see below.

Nominal includes journals in the figures but not separately. Tick the box on its own to see what is included.

Click OK to print report or Close to abandon

Note: The Nominal End of Period should be run immediately or soon after the VAT file is cleared to maintain proper VAT reporting – See Nominal ledger – VAT Return.

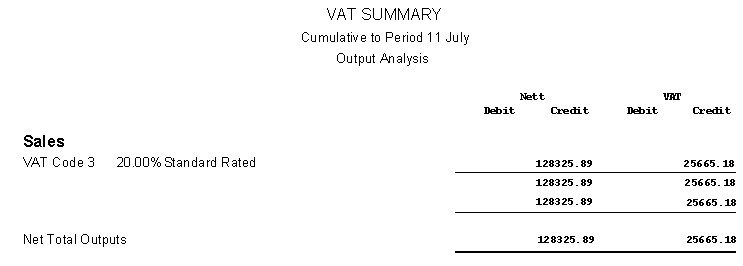

Ticking the check box gives just the net figures – like-

0 Comments