Post Automatic Stock Movements

In premium editions of Prelude Desktop the process for stock movement journals can be automated. Once configured, this happens automatically with every Trial Balance and Management Report run.

Two specific nominal account codes are required and must be configured:

Balance Sheet account to hold the Stock Valuation.

The pre-installed Code is CA01 – CURRENT ASSETS STOCK.

Profit & Loss accounts to hold Opening Stock and Closing Stock adjustments.

The pre-installed code is PU99 – PURCHASES/C.O.S. ADJUSTMENT FOR STOCK.

You may use these or set up your own nominal code structure.

Having set up the nominal codes you must activate the Stock on the Balance Sheet parameter in Nominal Ledger & Cashbook parameters. This activates the nominal control account fields to be populated with the codes you have set up (above).

If you do not post opening and closing stock journals, the Cost of Sales on the Profit and Loss Report would include the cost of your purchases, and not take unsold/unissued stock into account.

Example:

Your company buys stock costing £10,000, therefore your purchases on the Profit & Loss report are £10,000.

In the same month your company sells half of its stock for £12,000 therefore your sales are £12,000.

If your gross profit was calculated as sales less purchases then your company would appear to have made £2,000 profit even though you still have £5,000 worth of stock left unsold.

To produce an accurate profit figure the cost of sales must be calculated. The cost of sales value can be calculated using the following formula:

Opening Stock + Purchases – Closing Stock = “Cost of Goods Sold” or “Cost of Sales”

In our example, cost of sales = 0 + £10,000 – £5,000 = £5,000. Applying the cost of sales figure to the £12,000 sales the new gross profit would be £7,000.

Process:

Having done the above configuration, all processing will be automated from now on. For example, with a stock valuation of £20,000:

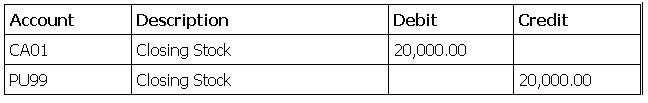

Whenever a Management Report or Trial Balance is run, the system will post the following temporary journal. This journal is not actually posted to the ledgers and will disappear when the Management Report or Trial Balance is closed.

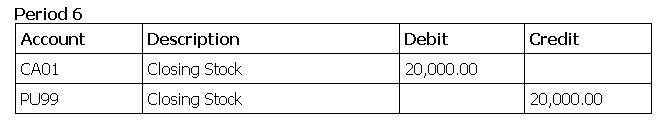

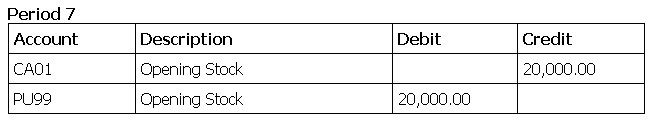

At Nominal Period End the system will post the following actual reversing journals – example for Period 6 ending:

Be sure to produce and print a Stock Valuation report before Nominal Period End processing – see Value Stock.

Balancing/Reconciliation:

To ensure complete and accurate Stock Valuation – and as a good business practice – you should perform regular stocktakes – see Print Lists to use at stocktaking.

Filing:

Immediately before running Nominal End of Period, you must produce and file the Stock Valuation Report to support the period-end stock valuation – see Value Stock.

0 Comments