Opening Balances And Prior-Year Adjustments

Purpose:

Enter your Opening Trial Balance after entering your Customers, Suppliers and Stock opening balances( if Stock on the Balance Sheet is activated in Nominal ledger & Cashbook Parameters.)

Also use to add Prior-Year adjustments, as the system works in real-time with your business and occasionally transactions are required for an accounting year some time after the accounts have been closed for that accounting year. For example, following an external audit, extraordinary transactions or the declaration of a dividend, adjustments will be necessary.

These prior-year transactions will affect the opening Balance Sheet Account balances in the current year and must be entered to the system in the current year to ensure the system remains consistent e.g. with published statutory accounts.

Entry as a standard journal would post these balances to the current period which would skew the results for the current period.

Instead use an Opening Balances Journal which posts these balances to period 0 (whatever the current period may be) to include them in opening balances in the current year and thereby keep the current system historically consistent while not skewing the current period’s results.

The forms used are similar to that used to Adjust Ledger Entries, except that, by definition, these journals can only be made to Nominal Ledger Balance Sheet accounts as they affect opening balances or balances brought forward from the previous accounting year – see notes below about P & L adjustments.

It is a good idea to take a copy of the company before the year end ‘roll-over’ and to name this with the Financial year i.e. ‘ xxxxx Ltd 2017/8’. You can then also post the adjusting journals to this company but post P & L adjustments to the P & L accounts – so you have a final Trial Balance and accounts that agree with the statutory accounts in detail as well as the correct balances for the following year.

You can use the journal to enter opening balances on your Sales and Purchase ledgers. Each account will just show the date and the opening balance amount. The journal balancing entry will usually be posted to the Suspense account and when the Trial Balance is posted as an opening journal the sales ledger and purchase ledger control account balances will be posted to the suspense account also to clear the suspense.

Preparation:

Collate the details of audit adjustments, extraordinary transactions etc. from the prior year and determine the opening Balance Sheet accounts and amounts to be processed.

Processing:

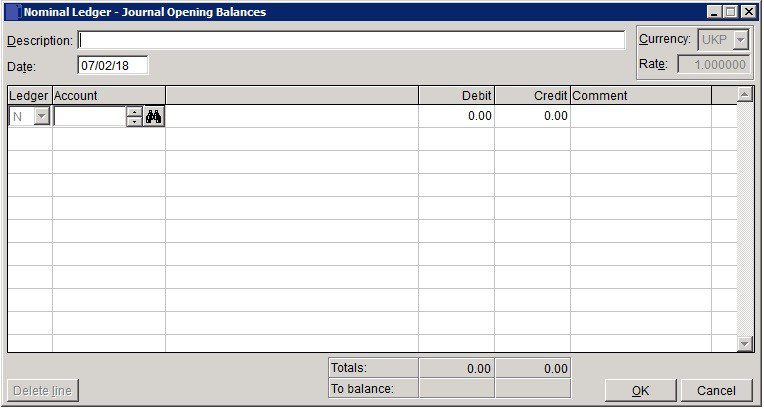

On the main menu click Ledgers > Nominal > Journals > Opening Balances.

Enter data as required – Note any P & L items must be posted to a Reserves account – if in doubt consult your accountant or Prelude dealer.

OK to post, Cancel to close form without posting.

Print as required.

Balancing/Reconciliation:

If you have a back-up or copy company for the prior year, It is worthwhile posting the actual prior-year transactions to this database – you can then run final accounts and compare to the audited accounts.

Filing:

File a copy of the journal with any supporting documents, as required, with Year End working papers.

- Description: Mandatory – enter brief explanation for the adjustment.

- Date: Enter the appropriate date or accept default Accounting Date – As these journals are opening balances it is usual to date these as the first day of the new financial year.

- Ledger: Select S for Sales Ledger adjustment, P or Purchase Ledger or accept default of N -Nominal ledger.

- Select Account and Cost Centre ( Nominal only – if activated).

- Debit, Credit: Enter either Debit amount or Credit amount for each line – a line cannot contain both.

- Comment: Brief note to be displayed in the nominal ledger against this entry.

- Delete Line: Highlight line and click on Delete.

- Totals: The sum of all entries in each of the Debit & Credit columns – these must be the same before the journal can be posted.

- To Balance: Must be zero before records are updated.

- OK: Updates record and displays transaction number of journal. Message Box – click Yes to print, No to close print form. If Yes – select required output for report.

- Cancel: Displayd Warning Message box – Click Yes to close form without update, No to return to form.

0 Comments