Create And Edit Nominal Ledger Accounts

Code Structure:

As with all records in the system, a Nominal Account requires a unique code.

The system is supplied to use a four-character Nominal Account Code structure configured as two groups of two characters. The first two characters of the code identify the top level, called the Group or Header code. The second two characters of the code identify the bottom level, called the Tail or Account code. Prelude Cloud’s account header structure is fixed whereas Prelude Desktop’s accounts structure can be modified and or extended to up to 8 characters. The structure can also be replaced by a totally numeric chart of accounts if desired.

A list of all these codes set up in the system is called the Chart of Accounts.

As an example: The Header Code ‘CA’ is used for Current Assets on the Balance Sheet. The individual Accounts are sub-grouped by the remaining two characters – CA04 for Current Assets – Bank, CA02 for Current Assets – Debtors Control etc.

The system comes supplied with a Chart of Accounts ready for immediate use. This may be perfectly adequate for the smaller business but may need amending or adding to for the larger business. The standard chart of accounts is designed for SME limited companies – sole traders, partnerships, LLPs and other organisation types, such as charities will require modification. Please refer to an accountant or Prelude Accounts for assistance.

As well as adding new accounts in Prelude you may amend or delete existing accounts except the pre-installed Control Accounts – see Nominal and Cash Book form in parameters. The control accounts code can be changed to a new code, once it has been set up, providing no transactions have been entered.

In Prelude Desktop you may wish to use and expand on this structure for your business or construct a new two-tier Chart of Accounts of your own in a blank company. The account structure can be up to 8 characters – any mixture of Numeric and Alphabetical. If in doubt please consult a qualified accountant or bookkeeper.

Preparation:

Obtain a recent print of the existing chart of accounts – see List Chart of Accounts.

Obtain budget details for input if required.

Ensure other users are not posting to the system.

Obtain required authorisation to add or amend accounts.

Processing:

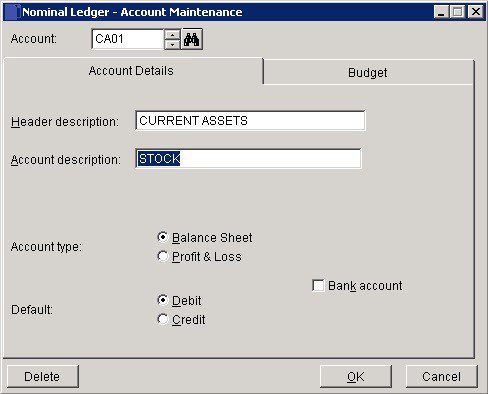

On the main menu click Ledgers > Nominal > Account Maintenance to open form- see Nominal Ledger Account Maintenance form below.

Either: type a new or existing code into the account field or: search or scroll to select an existing account.

Populate or amend fields or click Delete to delete the account. This is possible only on empty accounts and should be done with caution.

Click OK to update records or click Cancel to close form without update.

Select the item from the header code drop-down box for the account you wish to add, amend or delete.

Either: Select the item from the account code drop-down box if you wish to amend or delete an existing account or type a new code into the account code field.

Populate or amend fields or click Delete to delete the account. This is possible only on empty accounts and should be done with caution.

Click OK to update records or click Cancel to close form without update.

Limitations: For nominal control accounts, you may only edit the Budget amounts.

See Nominal and Cash Book parameters form for a list of nominal control accounts.

You may only edit the Account Name and Budget for other pre-installed nominal accounts.

You may add, edit or delete all end-user created nominal ledger accounts.

Balancing/Reconciliation:

Print new Chart of Accounts to make sure all required changes are complete and correct.

Filing:

Annotate new chart of accounts with dates and names of person making the changes – file copy as required.

- Header and Account Descriptions – the structure defined in Nominal Ledger & Cashbook parameters is 2-2 where the first part of the code is the header – Examples are: Fixed Assets, Current Expenses – i.e the headings you wish to see on your P & L and Balance Sheet.

- Create your Chart of Accounts first including the groupings above and then allocate codes to them – the first part for the heading and numerically for the accounts in the group.

- Enter the whole code in the account e.g. CA01 for Stock under Current Assets. When you enter CA02 the header description will be repopulated. Do not change the header description once entered unless you need to change it for all the accounts in the group.

- Enter account type and default debit or credit and check bank account if it is one- this creates a filter for bank reconciliations. Once this is done you must then create your control accounts in Nominal Ledger and Cashbook Parameters – if using foreign currency activate it first then create the control accounts.

- Note: This should be set up by an accountant or experienced book-keeper.

- Click OK to accept and and Cancel to close without saving.

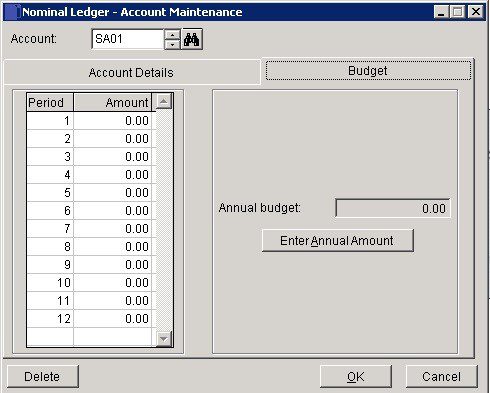

Enter Period amount for the year – this will accumulate in the annual budget figure.

OR

Enter Annual budget amount to spread evenly over the 12 periods.

Click OK to accept or Cancel to close.

Do not use Delete to clear the budget – simply re-renter it. Delete will delete the account unless it has transactions on it.

0 Comments