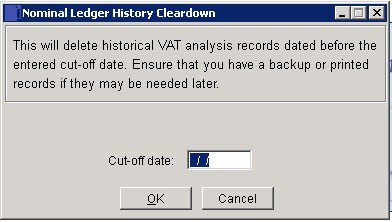

Cleardown History

Purpose:

To delete VAT analysis transactions whenever you feel it is safe to do so – particularly if you need to free up disk space.

If in doubt consult your Prelude dealer or your accountant.

Enter the Cut off date at a VAT Period End date – it is advisable to keep at least two VAT period details. Before clearing down ensure you have backed up copies of all the VAT analysis -possibly in one folder per VAT quarter-PDF files or Excel.

Also do a back up of the system and store in case you need to restore.

When ready enter the date and click OK. Click Cancel to abandon.

This process has no need for dedicated access.

0 Comments