VAT Return

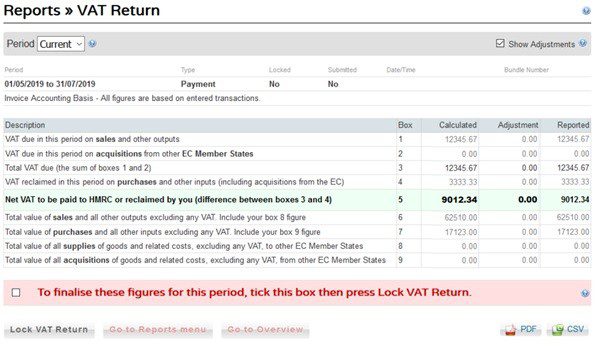

The VAT form has been modified to accommodate the additional schemes being introduced. The changes were not major and the VAT form looks like this:

The form will display the ledger figures in the Calculated column. Any adjustments must be made to the ledgers before finalising. Having confirmed that you are happy with these figures click on the tick box to finalise the figures, then Lock VAT Return. Do not Lock the VAT return on this until you are ready to submit the figures to HMRC. You can save at any time. After locking, the form will re-open. Tick the check box then click on Submit your VAT return. On acceptance by HMRC you will receive a submission receipt. You can print the PDF or export the CSV at any time. Submitting the VAT return will then flag all of the transactions that have been included in the return. The content of the VAT returns is retained for future viewing and can be accessed from the drop down labelled ‘Period’.

0 Comments