Management Reports

Overview

| Click on the blue title hyperlink to display the report . Each report can be reproduced at any time and exported as a PDF or CSV file. To see what the PDF and CSV reports look like see Sales Reports. |

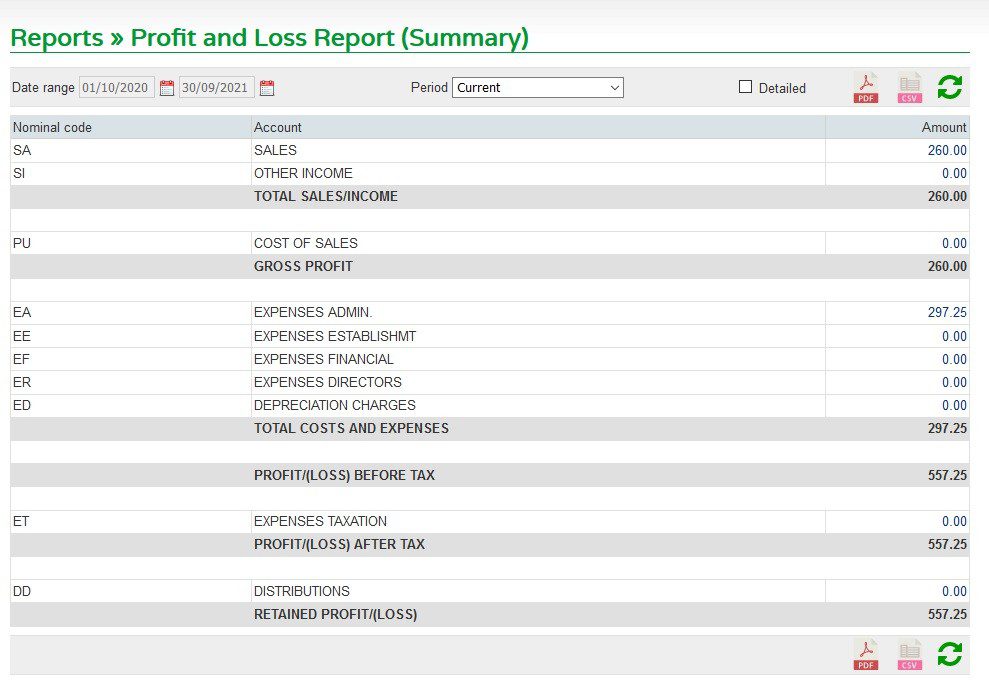

Profit and Loss Summary

Period dropdown allows you to change dates (ad-hoc), produce current year to date or All entries (cumulative to date). Choose pdf to print or csv to export to wherever you wish.

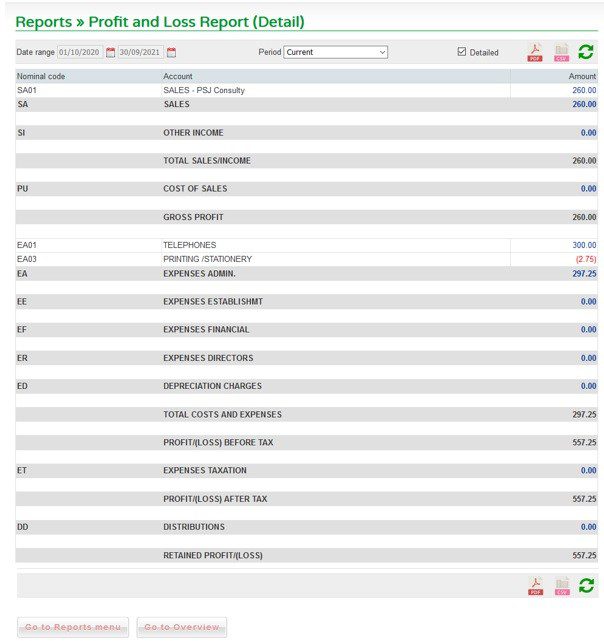

Profit and Loss Account Detail

Period dropdown allows you to change dates (ad-hoc), produce current year to date or All entries (cumulative to date). Choose PDF to print or CSV to export to wherever you wish.

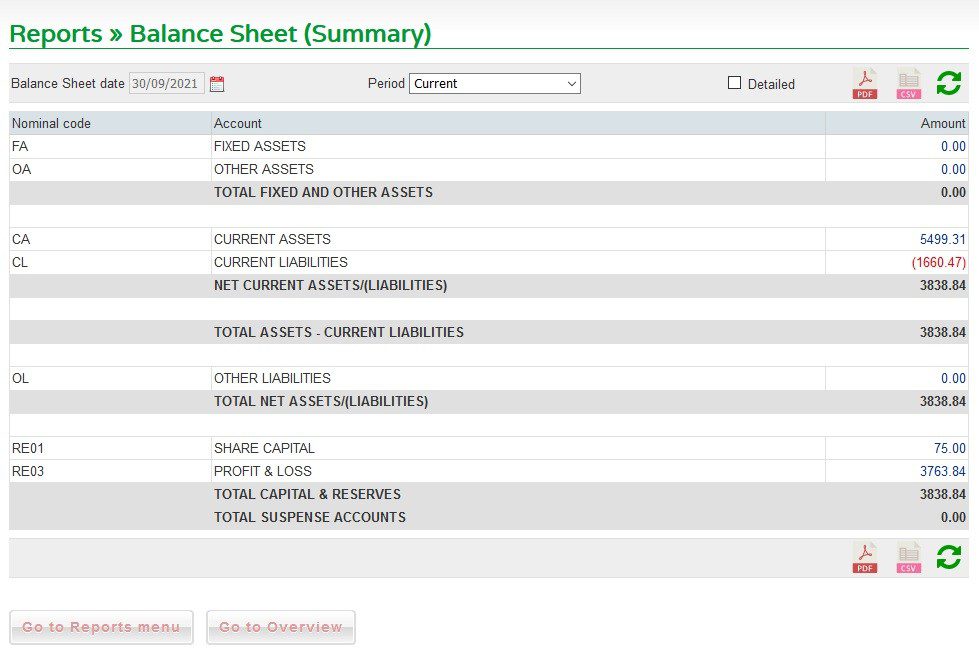

Balance Sheet Summary

Period dropdown allows you to change dates (ad-hoc), produce current year to date or All entries (cumulative to date). Choose PDF to print or CSV to export to whever you wish.

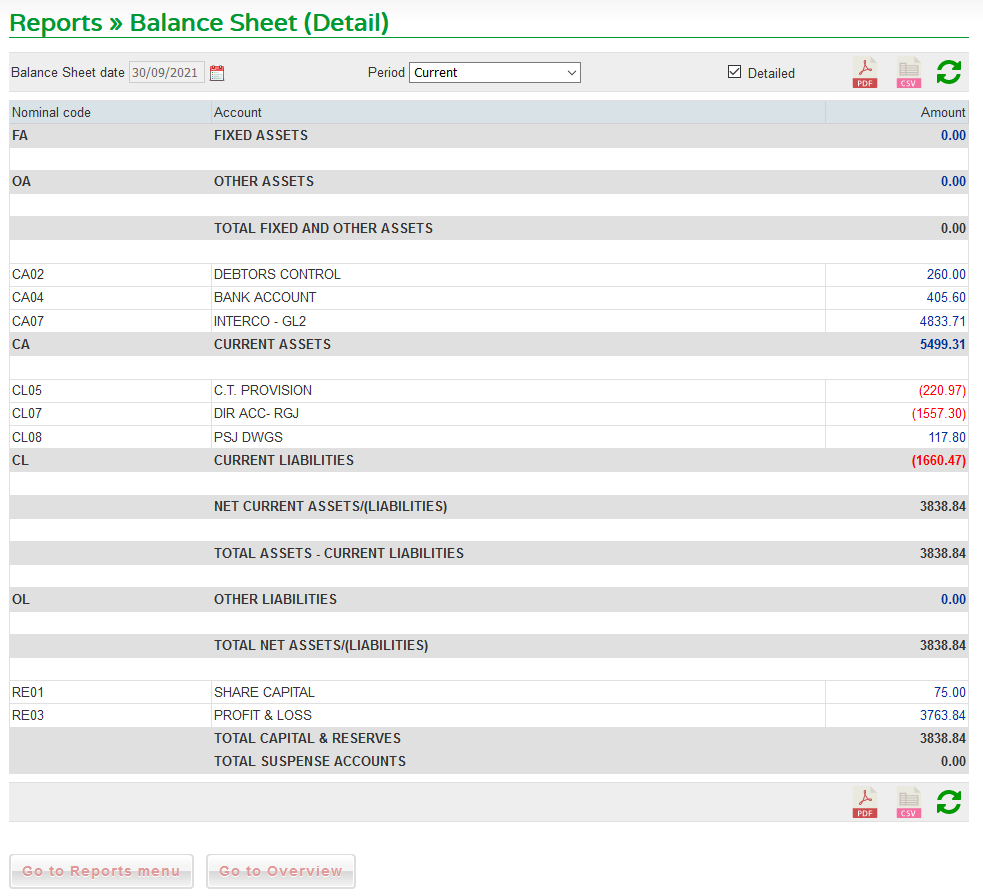

Balance Sheet Detail

Period dropdown allows you to change dates (ad-hoc), produce current year to date or All entries (cumulative to date). Choose PDF to print or CSV to export to whever you wish.

When selecting an Ad-hoc date for the Balance Sheet report, transactions dated after the selected date are excluded but all transactions dated on or before the selected date are included because the Balance Sheet is an ‘as at’ cumulative report.

When selecting an Ad-hoc date range in the P&L report, transactions dated outside that date range (before or after) are excluded because the P&L is a period report.

‘Current‘ period reports accommodate this:

- Current-period Balance Sheet includes all prior-period transactions and all current-period transactions that are dated on or before the current-period end date.

- Current-period P & L excludes all prior-period transactions and includes all current-period transactions that are dated on or before the current-period end date.

- Current-period transactions dated before the current-period start date are included to ensure the ‘Current‘ reports are consistent.

- Select the ‘Current: pre-dated’ Period to show the reports for only these current-period transactions dated before the current-period start date.

- If there are current-period transactions dated after the current-period end date, select the ‘Future‘ period to show the reports for only these future-dated transactions.

Note that prior-period transactions are those that have been assigned to past periods by the year-end routine.

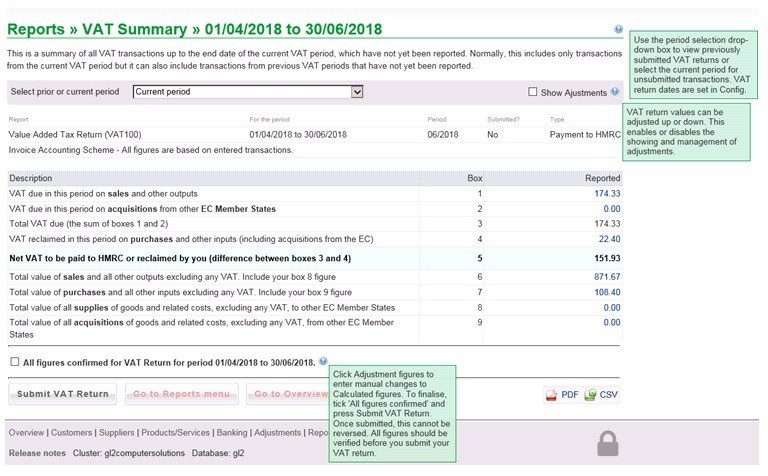

VAT Return

Read help notes – green above.

It will be beneficial to export PDF copy of Nominal enquiry for account CL01- VAT Control for the VAT period to confirm figures before submitting VAT return. See FAQ – How do I reconcile my VAT return?. Further details about VAT are given in the section- Making tax Digital and in Configure VAT.

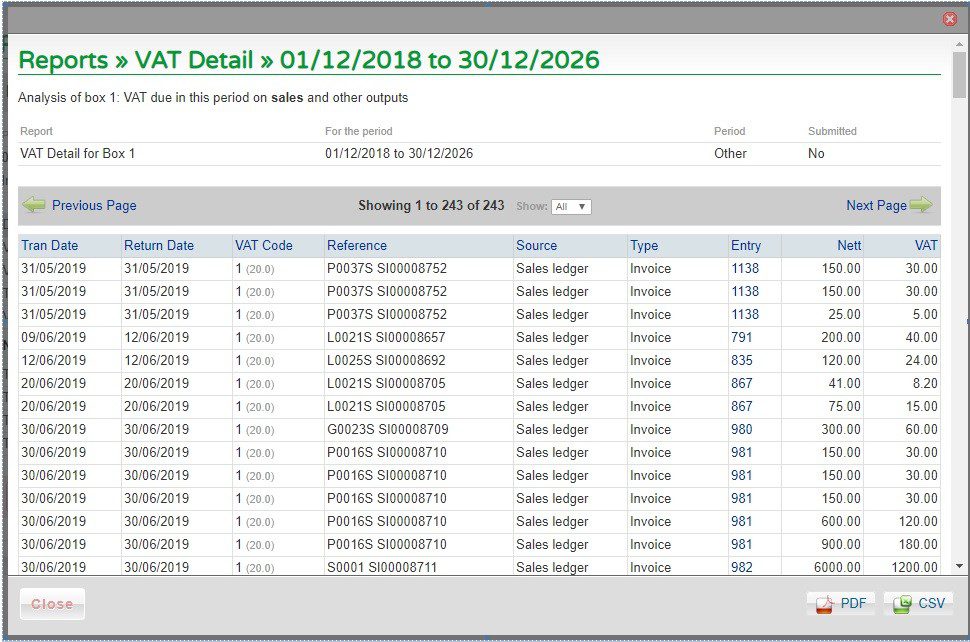

To drill down to the detail behind each figure – click on the figure to open up the details of transactions. Note the return date is the matched date – particularly useful for VAT cash accounting.

0 Comments