Error Messages

When signing up for MTD you may receive an error message if the signing up process has not been successful.

- That is the way HMRC account authentication works with MTD.

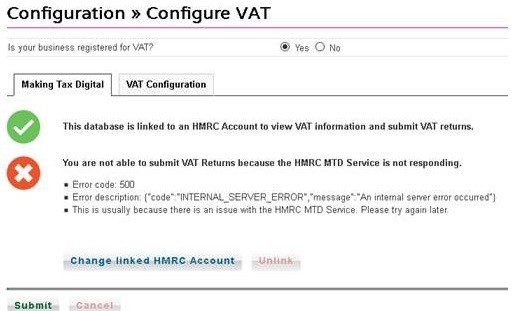

- Prelude is told only that the “database is linked to an HMRC Account” – the green tick in the screenshot.

HMRC doesn’t tell Prelude what HMRC Account it is connected to or whether it is the correct HMRC account or whether that HMRC account is registered for MTD.

HMRC then tells Prelude separately whether an MTD VAT Return can be submitted with the linked HMRC Account – the red cross in the screenshot

- It does this by responding with one of many possible software responses.

- Some of these responses are clear, we know what they mean and Prelude displays a clear explanation of what can be done with the selected HMRC Account and the selected VAT Return.

- Some of the responses are not clear, invariably are due to errors or unresolved issues, and Prelude displays as much information as it can and, if it can, what the user must do to resolve the problem.

- This is the case with the current response. You might have to contact HMRC to sort it out – 0300 200 3700.

- Error code: 500

- Error description: {“code”:”INTERNAL_SERVER_ERROR”,”message”:”An internal server error occurred”}

- This is usually because there is an issue with the HMRC MTD Service. Please try again later.

You may receive an error code 403 – this usually indicates that you haven’t signed up or that authorisation is pending.

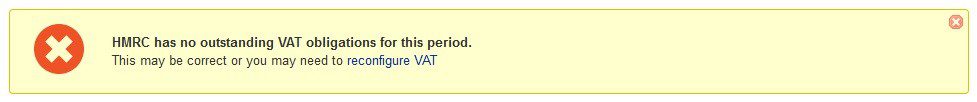

You may also see this error –

This usually occurs when the client has just recently just signed up or the VAT period is incorrect. Check the VAT configuration first. You will need to unlock the VAT Return to resubmit. If there is no issue with dates the client will need to contact HMRC on 0300 200 3700.

0 Comments