Currency – Exchange Differences Report

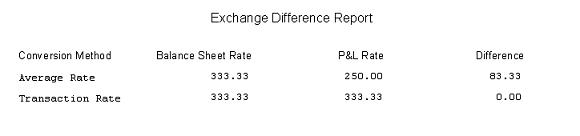

Purpose: Use this report to evaluate the effect of the different methods of conversion of Foreign Currency Profit & Loss transactions to Home Currency. This is implicit in Trial Balance and Management Reports.

The report displays the Profit & Loss result for each P&L Foreign Exchange conversion method and the resulting exchange difference .

Preparation:

Accepted Accounting Policies allow businesses to choose from a variety of different methods of conversion of Foreign Currency transactions to Home Currency for management reporting and statutory accounts production.

Balance Sheet Rate: Use the same exchange rates as those used to convert Foreign Currency Balance Sheet accounts to Home Currency. By definition, there will be no exchange difference if this method is adopted.

Average Rate: Use exchange rates that represent an average of the exchange rates during the reporting period.

Transaction Rate: Use exchange rates prevailing and entered at the time of each transaction.

The chosen method should be used consistently and applies to monetary – i.e. broadly trading – foreign currency transactions only. For non-monetary foreign currency transactions – e.g. purchase of fixed assets – the foreign currency amounts should be converted to home currency at rates prevailing at the time of the transaction and accounted for in home currency. Decide on your chosen conversion method considering trading and market conditions and potential volume of transactions.

See Choose an appropriate Currency Accounting Policy for a detailed explanation.

If in doubt, consult your Prelude reseller or a qualified accountant.

Obtain an up to date list of commercial exchange rates.

Input/update exchange rates as required – see Add & Amend Currencies & Exchange Rates.

Processing:

On the Main Menu Click Currency > Exchange Difference Report.

Select printer or document/export format – see Printing Reports.

Click OK to print/display/export to selected file type.

Filing:

As required. Auditors and/or Banks may require an additional copy of the report at the month and year end.

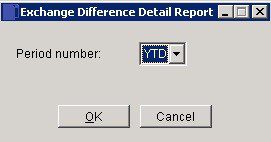

Select Period or Year To Date.

Click on OK to produce report or Cancel to abandon.

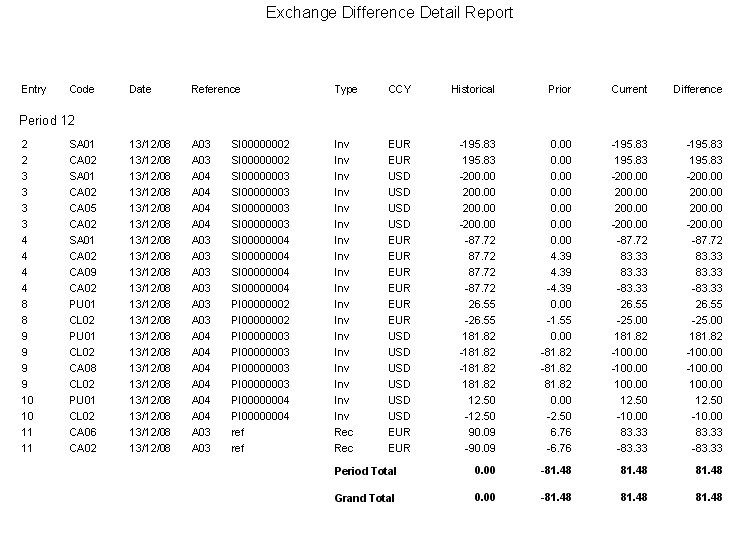

This report can also be produced by clicking on the line image icon in the Nominal Ledger > Exchange Difference Control Account. A similar report – Previous Period Revaluations report can be produced by clicking on the image icon where revaluation entries have been made e.g. Nominal Ledger > Debtors Control Account.

0 Comments