Cash Book – Post A Supplier Refund

Purpose:

For example, to correct for an overpayment you have made, to settle a goodwill discount on a disputed invoice or to settle a credit note for goods or services you have returned to your supplier.

Preparation:

Obtain an up-to-date supplier list – see List Suppliers.

Ensure supplier details are up to date – see Create & Edit Supplier Accounts.

Obtain details of which invoices are being refunded – if appropriate – ensure the supplier has issued you a credit note for the amount being refunded and that this credit note has been recorded – see Post Purchase Credit Notes to the Ledger.

Processing:

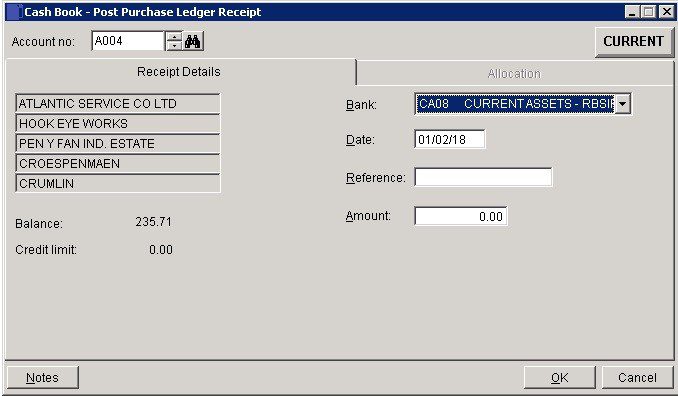

On the main menu click Daybooks > Cash Book > Receipts > Purchase Ledger.

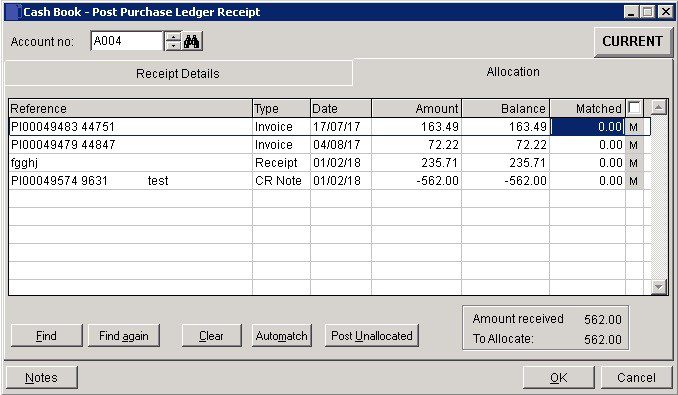

Match or part-pay monies – see Cash Book – Post Purchase Ledger Receipts form – below and also Match Sales or Purchase Ledger Transactions for an explanation of Matching.

Click OK to update.

Balancing/Reconciliation:

See Bank Reconciliation.

Reporting:

As required – see List Cash Book Transactions.

Update supplier notes as required

Filing:

File customer remittance advices in reference number order by period.

- Bank: Important! – Please select the bank account the receipt went in to.

- Date: Date amount received or date processed by bank – Either: manual entry formatted as DD/MM/YY. Type over the parts of the date you wish to change – the system will skip over the “/” part itself. If the date you enter is invalid; the cursor will return to the start of the date and await a valid entry, or; click on the field to highlight data – white on a blue background – then right click to open the Calendar Menu – see Dates and Calendar.

- Reference: As required – use paying in book page number for manual credits. Note that this field cannot be left blank.

- Amount: Actual amount received + discount allowed = amount credited to customer account.

- Click OK to move on to ‘Allocation’ tab or Cancel to close without action.

- If receipt covers total amount outstanding click check box next to ‘Matched‘, otherwise match receipt against line referring to items paid until ‘To allocate‘ is nil.

- If an item is part paid enter the amount in the Matched column.

- Amount received includes any discount allowed – i.e. the total value of the credit to the purchase ledger.

- Find: Click to open form. Enter a string from a reference to find a particular invoice and click OK. The program will search for the entered text string in the Reference field of a transaction. ‘>’ to the left of the line indicates a matching record.

- Find Again: Search for the next record matching the criterion entered.

- Clear: Clears all matching entries made on this page – allows you to start again.

- Automatch: Matches exact amounts received against sequential invoices starting with the oldest invoice. Will not allow part-settlement.

- Post Unallocated: Post entire amount as unallocated. Warning message box appears – click Yes to action, No to return to page.

- Notes: Open Notes form and enter text as required. Notes are stored as a permanent record and are specific to a Ledger account or Product or Service. They can be read and updated at any time by any user with access to the company. Entries should ideally show a date and the name or initials of the author. Entries will make a NOTES flag visible whenever the Ledger Account/Product is selected.

- Click OK to close allocation page, update records, display transaction number on form. Click Cancel to close without updating.

Search for existing details

Please refer to https://help.prelude.software/knowledge-base/cash-book-post-sales-ledger-receipts/ – bottom of page for details of search facility

0 Comments