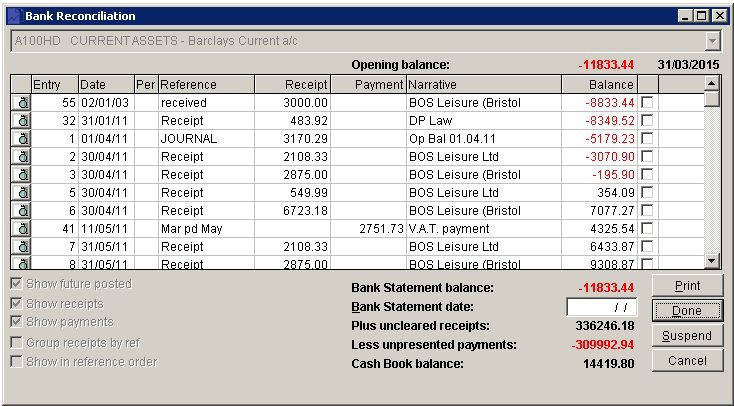

Cash Book – Bank Reconciliation

Purpose: To ensure no transactions going through your bank account are missed, incorrect or fraudulent.

Reconcile the bank accounts regularly daily, weekly, monthly depending on Cash Book transaction volumes and complexity.

Preparation:

Obtain latest copies of bank statements.

Supporting documents as needed.

Processing:

On the main menu click Daybooks > Cash Book > Bank Reconciliation, or; On the main menu View > Configure Toolbar open form – see Configure Toolbar.

Check the box to the left of Bank Reconciliation.

Click Apply button to display the control button – click the control button to open the form.

- Select Bank Account . Note date of last reconciliation.

- Check Show Receipts and Show Payments in order to assist with checking against bank statement.

- Check Group receipts by ref to display receipts grouped by similar references (e.g. show all BACS transactions together).

- Check Show in reference order to display items sorted by reference.

- Enter the Bank Statement date.

- The check box next to Balance will check all – useful if all or nearly items have been presented – you can then uncheck the items not presented.

- The Bank Statement balance is calculated from the Cash Book balance adjusted by the uncleared or unpresented items. As you check the cleared items the Bank Statement balance changes.

- Continue until reconciliation figures agree – i.e. The Bank Statement figure.

- Print finished reconciliation.

- Click Done to update and clear down agreed transactions.

- Note: Suspend will save what you have reconciled so far in case you wish to post corrections.

Filing:

File final print of bank reconciliation with Cash Book documents. Note number and date of bank statement showing agreed balance on the filed copy of the bank statement.

0 Comments