Bank Reconciliation

Purpose:

To ensure that all transactions from the bank statements are included in the accounts and that any differences are resolved.

Processing:

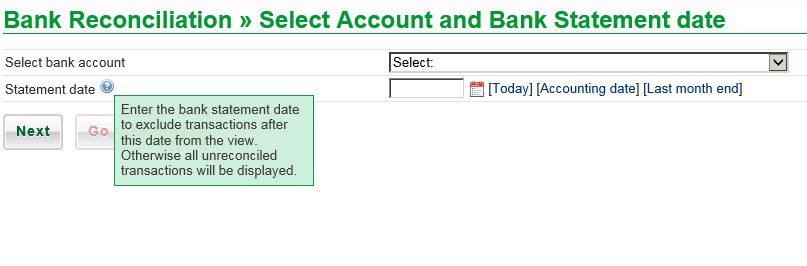

Click on Banking > Bank reconciliation.

Select the bank account you wish to reconcile.

Select statement date – it should be the latest date of the statement you’ve received or the last day of the accounting period. Either input date, use Datepicker or select one of the [date] options – note the help statement – viewed by hovering the mouse over the ? symbol.

Click on Next.

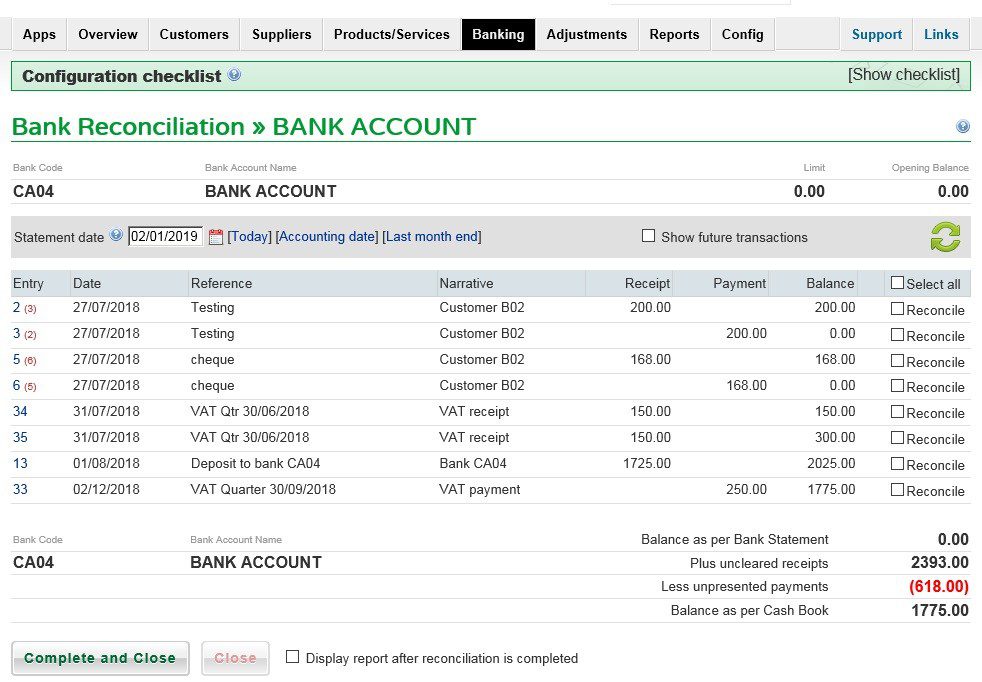

Check that the Balance as per Bank Statement on the form agrees with opening balance on the bank statement – resolve any differences.

Compare the details on this form with your bank statement and if the item is showing on the statement tick the Reconcile checkbox and tick the item on the statement.

Continue until the closing balance per the bank statement agrees with the Balance as per Bank Statement on the form. Check that the outstanding items are valid.

When happy, click Complete and Close.

Notes: If you need to make amendments before final reconciliation, click ‘Close’, make the corrections then return to this form to continue the reconciliation.

You can change dates if you need to and tick the ‘show future transactions‘ box to view future-dated transactions that have been posted – maybe the one you’re looking for has been posted with the wrong date.

If you wish to leave the process or it is aborted, you can come back later – the items reconciled will remain – you will not have to start again.

Tick the ‘Display report after reconciliation is completed‘ to print the bank reconciliation. The report is produced as a PDF document that you can print and/or save, or save the report as a CSV file.

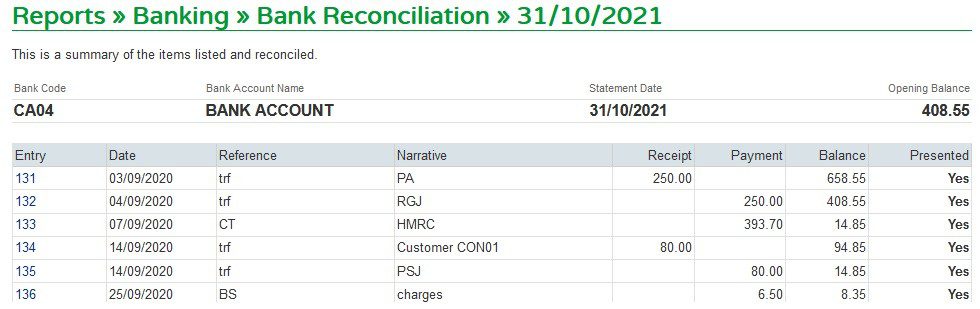

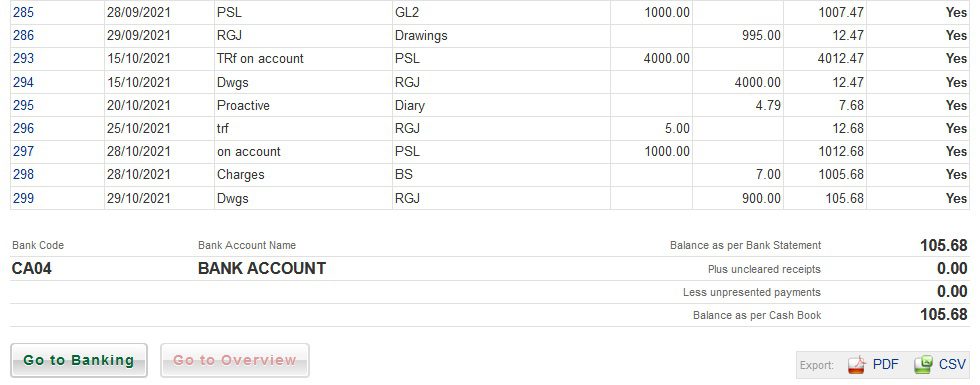

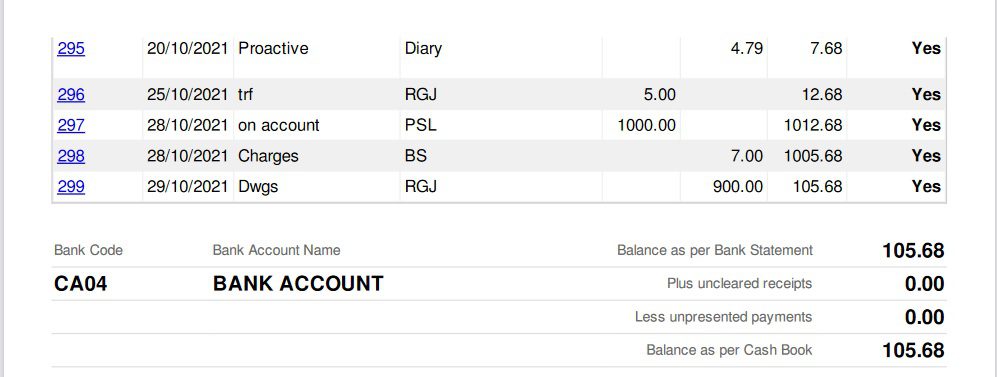

A Bank Reconcilation Summary report is produced.

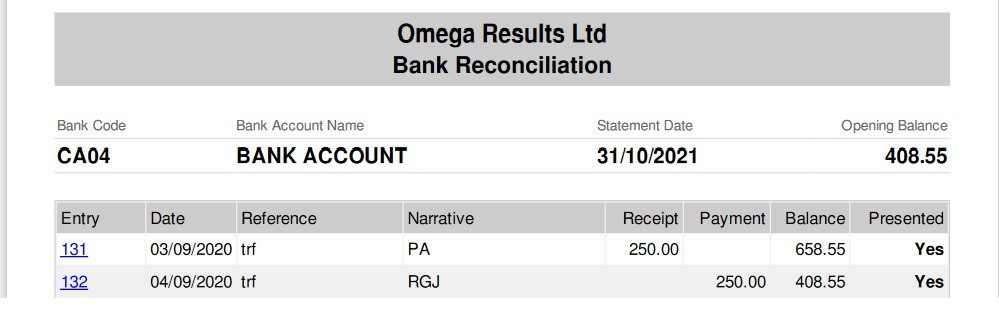

The PDF looks like this:

A csv file is also available.

0 Comments