Bank Deposit

Purpose:

To process multiple items, e.g. cheques, posted in one bank account entry – Counter credits – comprises Customer, Supplier and Sundry receipts.

Processing:

Click on Banking >Bank deposit – title(hyperlink).

Enter all cheques etc. into paying in book, then process the receipts as below and ensure total on form agrees with total on paying in slip.

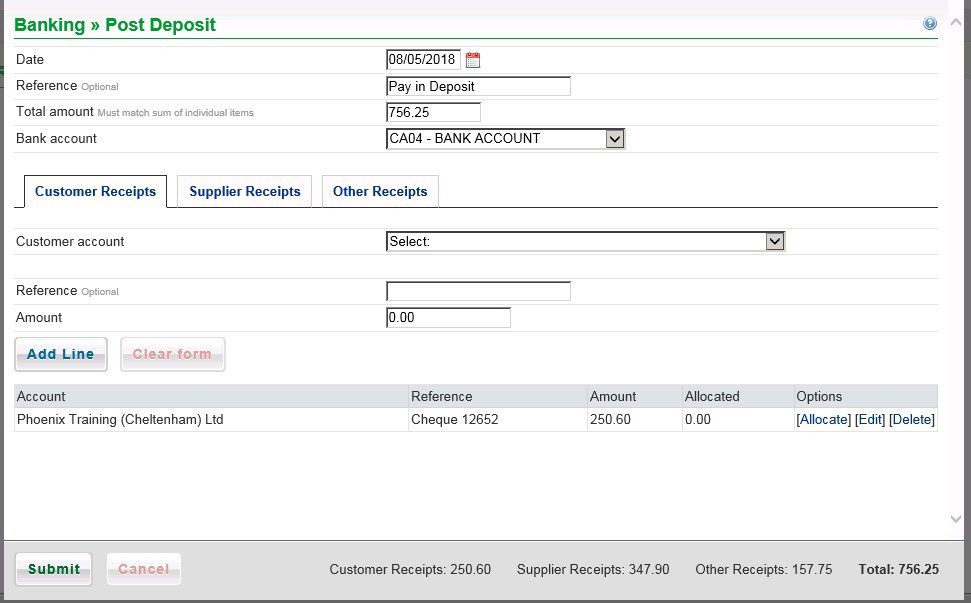

Customer Receipts

If date different overtype or select from Datepicker.

Enter Reference, Description and Gross Amount.

Select Customer, enter a Reference and enter amount.

Click on Add line to transfer to listing and update totals.

Click on [Allocate] to match receipt on customer account, [Edit] to amend or [Delete] if not wishing to process now.

If no other entries click on Submit.

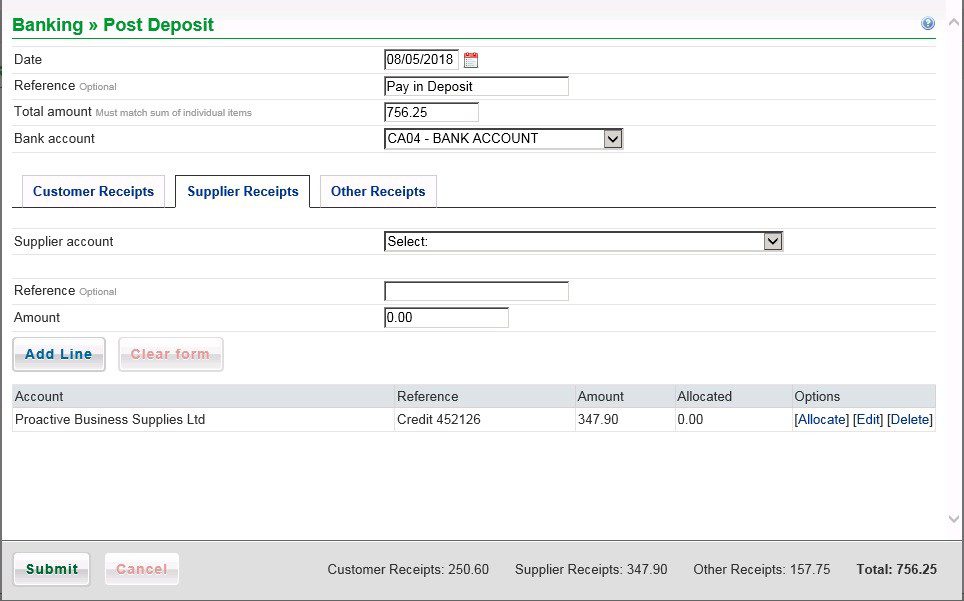

Supplier Receipts

Select Supplier, enter a Reference and enter amount.

Click on Add line to transfer to listing and update totals.

Click on [Allocate] to match receipt on supplier account, [Edit] to amend or [Delete] if not wishing to process now.

If no other entries click on Submit.

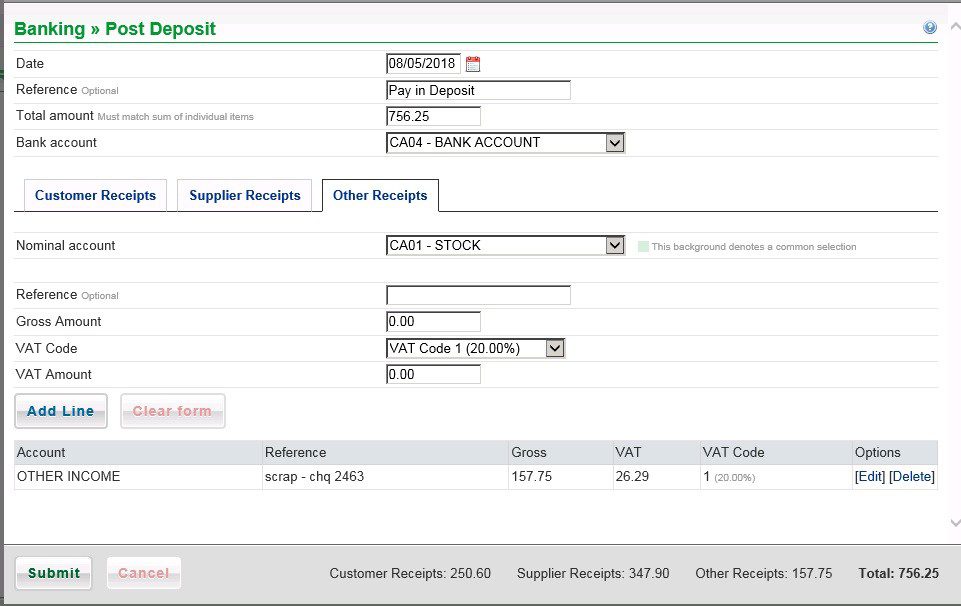

Other Receipts

Select Nominal account, add Reference and enter Gross amount.

Select VAT Code – VAT amount will be calculated – check against any remittance document and modify if necessary.

Click on Add line to transfer to listing and update totals.

Click on [Edit] to amend or [Delete] if not wishing to process now.

If no other entries check that totals agree then click on Submit , or click on Cancel not to post.

0 Comments