Adjustments Menu – Overview

With any accounting system there will be errors and adjustments to make, plus entries that have to entered into the nominal ledger that aren’t processed through the sales or purchase ledgers or cash book.

Entries often have to be made by your accountant (or yourself, if you have the knowledge) for liabilities that need to be adjusted at the year end that haven’t come through that relate to the financial year – accountancy charges, taxation, interest charges and likewise payments in this financial year that partially relate to next year need to be adjusted – e.g. rates, insurance, subscriptions.

If you have employees, entries need to be made to bring their costs into the ledger and if you have assets – machinery, computers, vehicles then depreciation and possibly hire purchase or finance charges need to be included.

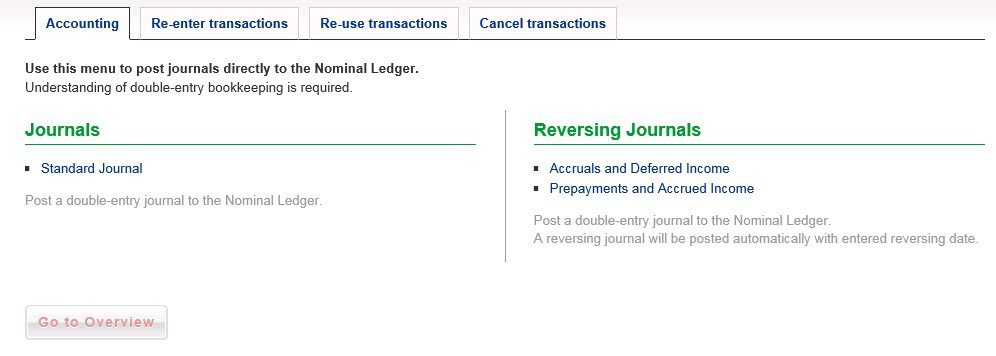

This section deals with this type of transaction.

0 Comments