How Do I Add Cumulative/ Running Totals To Statements.

Please go to https://help.prelude.software/knowledge-base/sales-ledger-print-customer-statements/ and read the paragraph at the bottom of the page. This can also be used for Remittance Advices.

Please go to https://help.prelude.software/knowledge-base/sales-ledger-print-customer-statements/ and read the paragraph at the bottom of the page. This can also be used for Remittance Advices.

Usually to create a new supplier account or edit an existing supplier’s account details, click menu Ledgers > Purchase > Account Maintenance.

Alternatively, click the Purchase Ledger Account Maintenance button on the toolbar.

It is a good idea to have a fixed structure for your supplier codes to help you identify and group them.

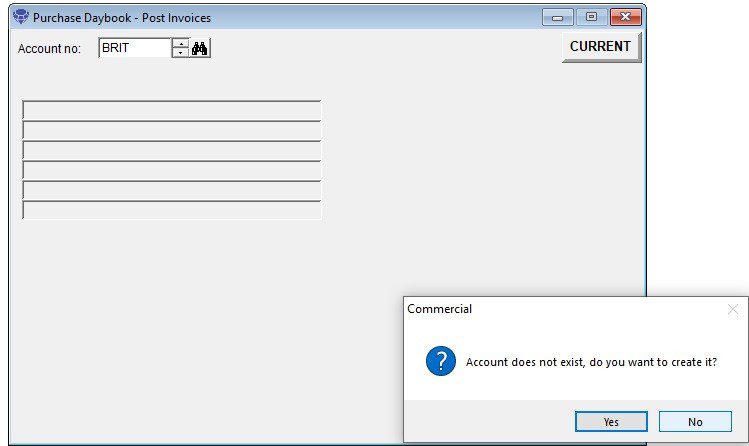

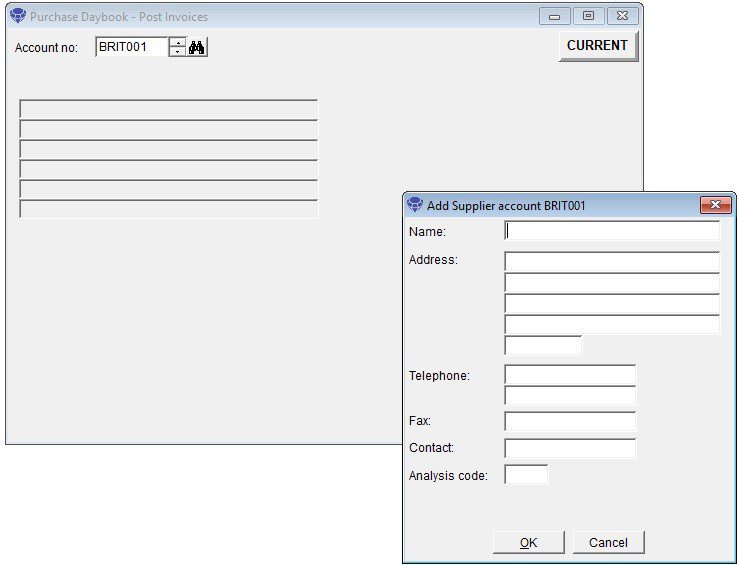

Sometimes you may be in the process of posting invoices and do not have an existing supplier – You can continue to process the invoice – just identify from the drop down list the next account number you can use, enter it and you will be asked if you wish to create a brief version of the account – enough to continue with the invoice. Make a note of the account number and later go to the account – see above , and complete the rest of the details. See the following images for how it’sdone.

If you wish to use the register open Menu > View > Parameters ? Purchase > General Page check ‘Use Invoice Register‘

To record a supplier invoice, click menu Daybooks > Purchase Daybook > Post Invoices.

Alternatively, click the Post Purchase Invoices button on the toolbar.

The Purchase Daybook Post Invoice Form is displayed.

Select the supplier whose invoice you want to post and enter the invoice details.

Once you’ve entered all the invoice details, click OK to record it.

The details of the postings are now available on Ledgers > Purchase > Invoice register. Once an invoice has been authorised you need to update the ledger from this sub menu.

Note: A cash purchase doesn’t normally involve a supplier invoice (there may be a Cash Sale Invoice) and often reimbursement is made from petty cash.

If you want to record a supplier invoice or your supplier allows you to delay payment, you should Record an Invoice.

You can either record the expense immediately – click menu Daybooks > Cash Book > Payments > Petty Cash.

The Petty Cash Payment Form is displayed.

Enter the cash expense details which will be credited automatically to the Petty Cash Control Account.

OR you can post all the period’s payments as part of the period end routine and balance the petty cash tin at the same time.

See more details in Process Petty Cash Payments in the Cash Book section.

Note: Small value receipts don’t always show the VAT separately (Amount is VAT inclusive). You can claim back the VAT element providing the document shows a valid VAT number and is dated.

Note: You should normally receive a credit note from a supplier before receiving a refund unless there has been an over-payment

To record a Supplier refund, click menu Daybooks > Cash Book > Receipts > Purchase Ledger.

The Post Purchase Ledger Receipt Form is displayed.

Select the code for the supplier giving the refund.

Enter the amount and allocate it against the credit note you received or the payment which caused the over-payment.

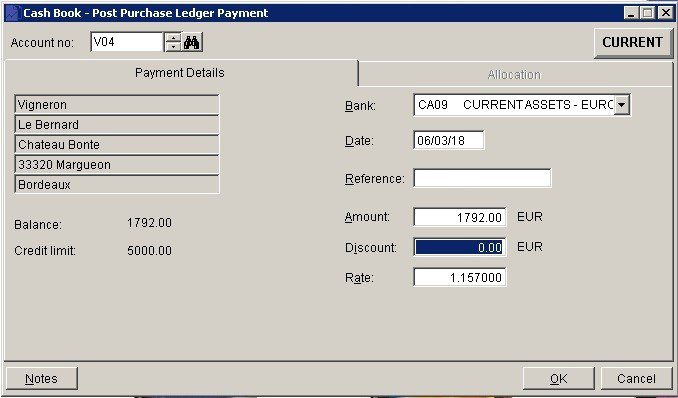

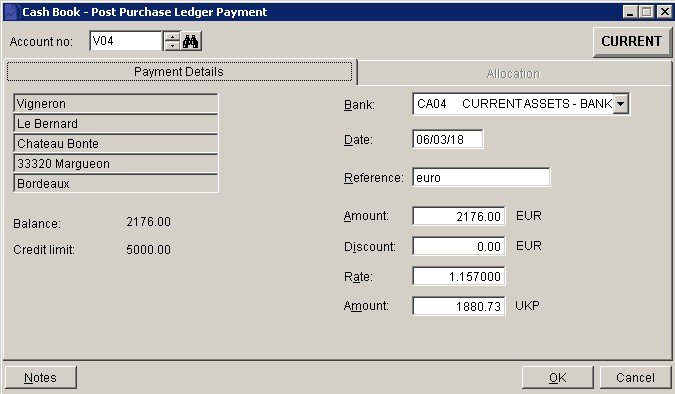

To record an invoice payment, click menu Daybooks > Cash Book > Payments > Purchase Ledger.

Alternatively, click the Post Purchase Ledger Payments button on the toolbar.

The Post Purchase Ledger Payment Form is displayed.

If the bank account is in the same currency – as above – the process is the same as sterling although you may have to create a separate nominal account entry for any bank charges.

If the payment was made out of a sterling account then –

When reconciling the bank account you will have three entries in the bank account to match the one on the bank statement.

Note: To record a credit note, see Record a Supplier Credit Note.

Allocating a credit note to an invoice is a particular example of matching Purchase Ledger transactions.

Click menu Daybooks > Cash Book > Match PL Transactions.

The Match Purchase Ledger Transactions form is displayed.

Type the code for the relevant supplier.

Once you’ve entered all the details, click OK to record the allocation.

See more details in Match Sales or Purchase Ledger Transactions in the Cash Book section.

See the above links to see a detailed explanation of all the entry fields in these forms.

There are several ways to deal with these and it really depends on how many there are to deal with at any one time.