How Do I Add Cumulative/ Running Totals To Statements.

Please go to https://help.prelude.software/knowledge-base/sales-ledger-print-customer-statements/ and read the paragraph at the bottom of the page. This can also be used for Remittance Advices.

Please go to https://help.prelude.software/knowledge-base/sales-ledger-print-customer-statements/ and read the paragraph at the bottom of the page. This can also be used for Remittance Advices.

Step 1

Amend the invoice stationery design

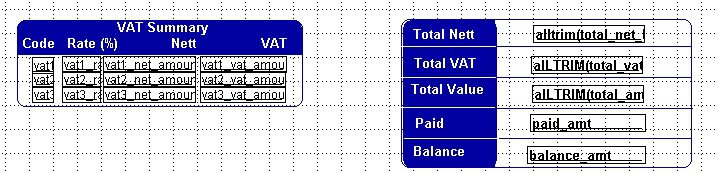

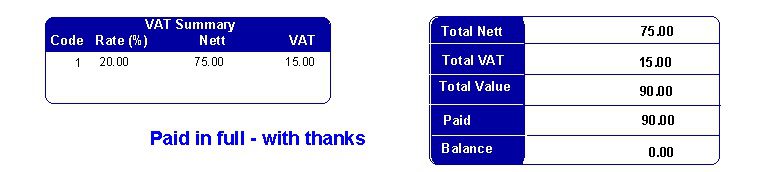

Extend the Net, VAT and Total fields block downwards and add AMT_PD and BALANCE_AMT from the data envirionment – Do this for all the invoice options you use.

Step 2

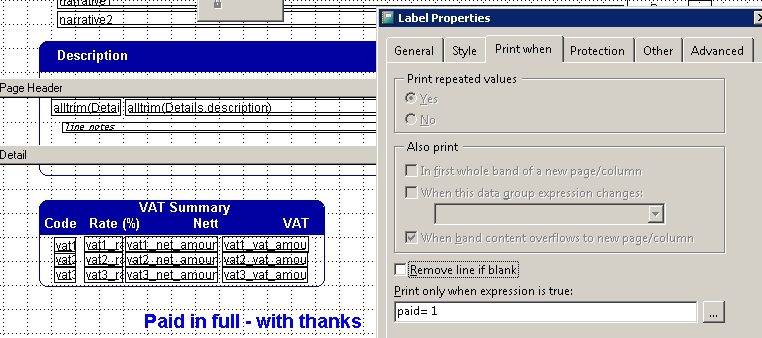

Add conditional comment to the stationery design

Use the text field and format the phrase you want. For it to appear only when it has ben paid enter PAID=1 in the ‘Print When’ properties tab.

Step 3

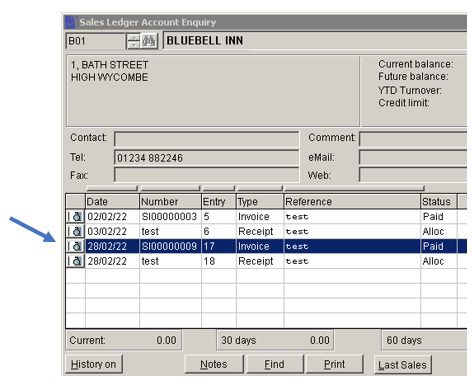

After the invoice has been paid and allocated – use ‘Reprint’ –

Step 4

Print or email the invoice and send to customer –

Purpose: To make the necessary transactions at the start of a Hire Purchase contract.

General: There are essentially two types of lease – 1. Finance lease – where you are effectively borrowing finance to pay for goods you will own at the end of the finance; and 2. Operating lease – where you effectively hire the goods and pay for the use but never own the goods.

Hire Purchase is a type of finance lease.

With Hire Purchase you usually receive an invoice for the goods and an HP agreement with details of the purchase price, the VAT element, the deposit , the net amount financed, the terms and monthly repayments and details of the final option to purchase amount.

The Accounting Process: Firstly, we deal with the invoice.

1. Create an account in the purchase ledger for the supplier of the goods.

2. Post the invoice. If a vehicle, post the cost to Fixed Assets vehicles and post any non capital items such as road fund licence to motor expenses and fuel supplied to Fuel. For electric vehicles there may be a grant to take care of as well. In this process you will take care of the VAT as well. For other items find the appropriate fixed asset account.

Secondly, we set up a HP liability account in the Current Liabilities section of the nominal ledger. If you are likely to have more than one HP agreement create separate accounts for each.

Thirdly, we post a credit to the Supplier account to clear it and transfer the amount to the HP liability account. Match these items to keep the account tidy. Code this as VAT code N if posting a dummy credit note or you can create a standard journal entry.

Fourthly, post any deposit paid to the HP liability account.

Fifthly, create a HP interest account in the finance expenses section.

Finally, work out the monthly capital repayment = Balance on HP liability account (amount financed) divided by number of repayments. The difference between this figure and the monthly amount repayment shown on the agreement is the HP interest. When each repayment is made you will need to split the amount and post the capital amount to the HP liability account and the interest to the HP interest account.

The final payment will include the option to purchase – this is a finance cost and should go to finance charges in the finance expenses section. There will be VAT on this charge.

When acquiring fixed assets from overseas, record the cost of the asset in your functional currency using the spot exchange rate on the date of acquisition. This means converting the foreign currency amount of the purchase price to your local currency using the relevant exchange rate.

Detailed Explanation:

1. Initial Recognition:

When you purchase a fixed asset in a foreign currency, the cost must first be converted into your functional currency (the currency used to present your financial statements) using the spot exchange rate that was in effect on the date of the asset's acquisition.

Purpose: To send send copy invoices marked as such so that duplications don’t occur.

Process:

Go to ‘Edit a produced invoice‘, the select the customer and the relevant invoice.

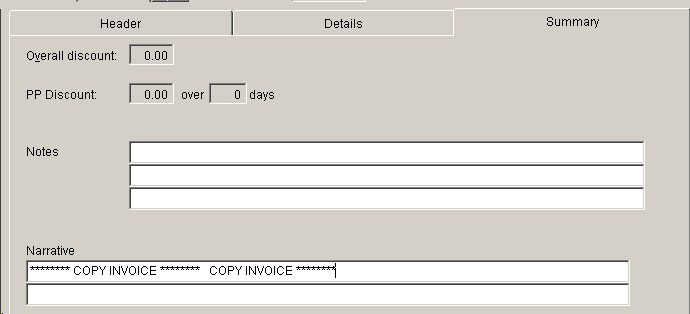

Go to the Summary tab and enter ‘Copy invoice’ or appropriate wording as boldly as you wish into the narrative field.

This will not affect any postings. However you may need to add the Narrative fields to the invoice stationery design – see https://help.prelude.software/knowledge-base/file-menu-stationery-design-data-environment/

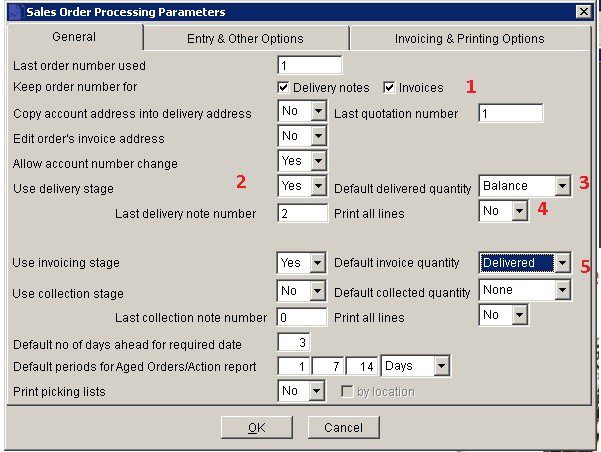

Change Sales Order Processing Parameters to –

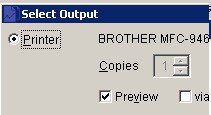

Enter a sales order at beginning of month/week as normal for the first delivery. Ensure print is set to Preview –

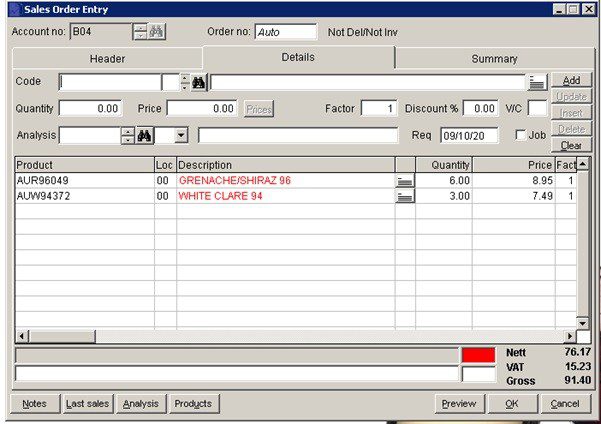

After entering details – like so

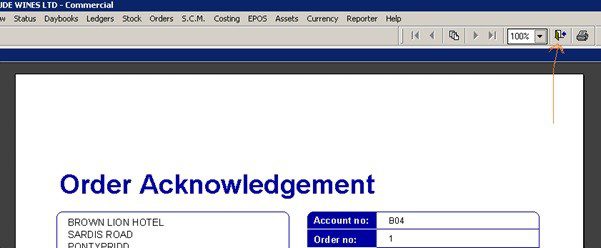

and pressing OK you will get Order Acknowledgement –

Close door to not print.

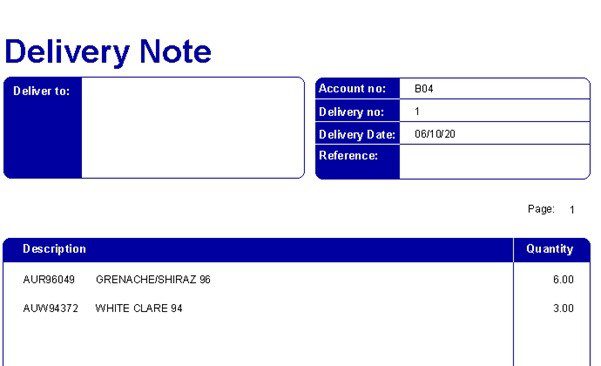

Print Delivery Note (Deliver Goods)

DO NOT print invoice.

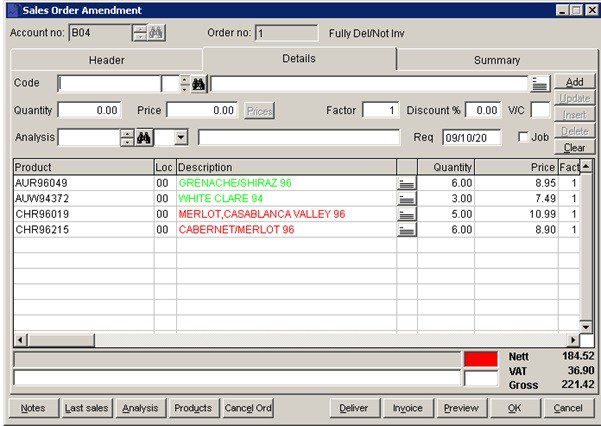

Next Delivery – Open existing order – Amend Order and add items – Preview on – don’t print Order Acknowledgement – as above. See below two items added.

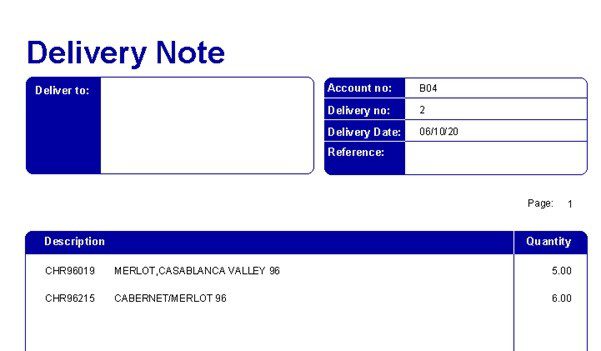

Print delivery note – see it’s for the last items delivered only.

Continue like this until end of month/week and after last delivery print the invoice.

Usually to create a new customer account or edit an existing customer’s account details, click menu Ledgers > Sales > Account Maintenance.

Alternatively, click the Sales Ledger Account Maintenance button on the toolbar.

It is a good idea to have a fixed structure for your customer codes to help you identify and group them.

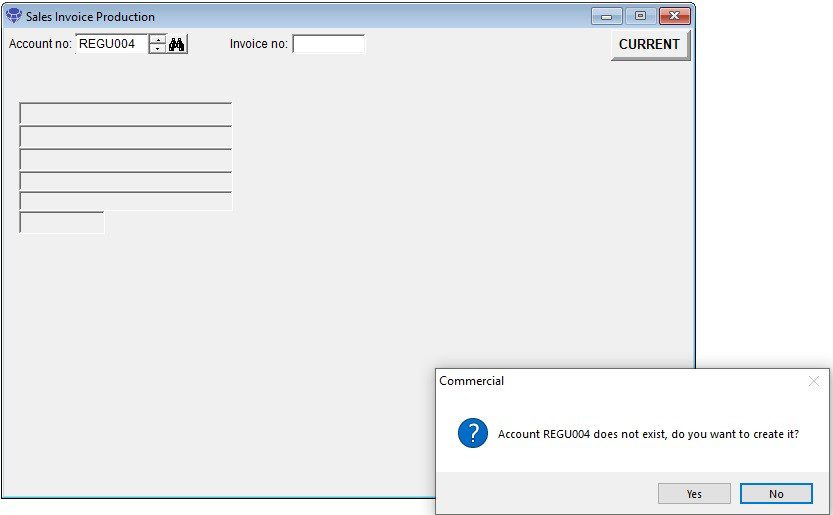

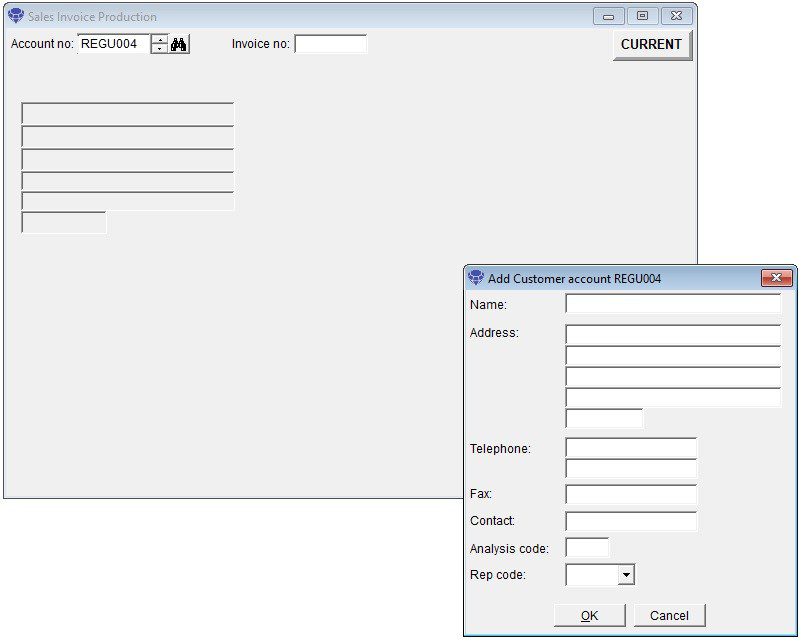

Sometimes you may be in the process of posting invoices and do not have an existing customer – you can continue to process the invoice – just identify from the drop down list the next account number you can use, enter it and you will be asked if you wish to create a brief version of the account – enough to continue with the invoice. Make a note of the account number and later go to the account in Ledgers > Sales > Account Maintenance. and complete the rest of the details. See the following images.

To create a Customer invoice, click menu Daybooks > Sales Daybook > Produce Invoices.

Alternatively, click the Produce Sales Invoices button on the toolbar.

The Select Output Form is displayed, followed by the Sales Invoice Production Form after you have selected your output option – e.g. printer or PDF document.

Select the customer you want to invoice and enter references on the header page. Click on the details page.

Ignore the stock selection binoculars (Code) and enter the invoice details into the description line. Click on the line notes button to add further details.

Once you’ve entered all the invoice details, click on Add to add to the grid. you can add further lines or continue to the summary page or click on OK to save. The invoice can be amended later, if necessary.

The invoice will be produced to your selected output and will appear in the customer’s account listing (accessible by clicking menu Ledgers > Sales > Account Enquiry) – see Sales Ledger Account Enquiry Form.

You can re-print the invoice from this form.

See more details in Produce Sales Invoices in the Sales Daybook section.

You may have an overseas customer who wishes to be invoiced and pay in Euros and you only have a Sterling account.

When the customer pays you will get an advice from your bank, showing the Euro value, the Sterling equivalent and the bank charges.

When you process the bank reconciliation you will see three entries in the cash book relating to that one transaction.

Note: A cash sale doesn’t produce an invoice document and records a payment at the time you make the sale.

If you want to produce an invoice document or you allow a customer to delay payment, you should Create an Invoice.

To record a cash sale, click menu Daybooks > Cash Book > Receipts > Cash Sales.

Alternatively, click the Post Cash Sales button on the toolbar – see Configure Toolbar.

The Cash Receipt Entry Form is displayed.

Enter the cash sale details which will be debited automatically to the Cash Sales Control Account.

Once you’ve entered all the cash sale details, click OK to record it.

See more details in Process Cash Receipts in the Cash Book section.

Note: Prelude Cloud has its own cash sales section – see Cash Sales.