How Do I Deal With Prompt Payment Discounts?

Many businesses offer customers a discount if they pay their invoices early.

Prior to 1st April 2015 when you offered a prompt payment discount you should have charged V.A.T. only on the discounted amount, even if the customer didn’t take advantage of the prompt payment discount offer. However on 1st April 2015 HMRC changed the rules and VAT is now payable on the amount received.

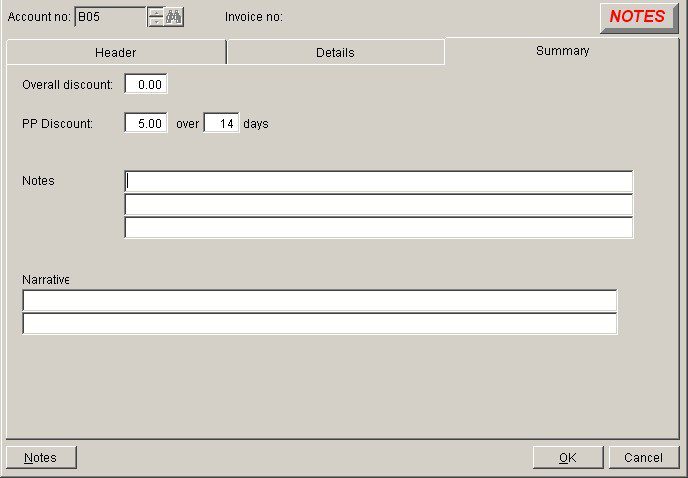

The invoicing part hasn’t changed and is shown here: Add the overall prompt payment discount percentage and period in days to the summary of your invoice like this:

You may need to update your stationery design to include the discount and period in your invoice footer – see Design Your Stationery.

Customer Receipt

When the customer pays you need to check whether he has paid the discounted amount within the time allowed. If he has then simply record the receipt as is and allocate the receipt as normal.

If the receipt is outside the terms you need to decide whether to request the difference – by invoice – discount + VAT.

If the customer has paid the full amount as he was late in paying you will need to split the payment – match the amount paid to the customer’s account and post the difference as a VAT inclusive nominal receipt extracting the VAT and posting the balance to the appropriate sales account.

This process applies to supplier invoices too. When invoices are received post them at full value. When paying, deduct the discount and post to the discount account. That discount will include VAT. Each month determine the amount of discount for the month and transfer the VAT element to the VAT account – It’s probably best to create a dummy purchase ledger account.

Payment: Dr. Supplier Acccount – Full amount Cr. Dummy P/L Discount Cr. Cash Book Net Amount paid.

Monthly: Dr. Dummy P/L Discount account with full amount by credit note( splitting out VAT element) Cr. Discount Received acccount – Net and Cr. VAT account.