How Do I Process a CIS Deduction?

Paying a Subcontractor with a CIS (Construction Industry Scheme) Deduction.

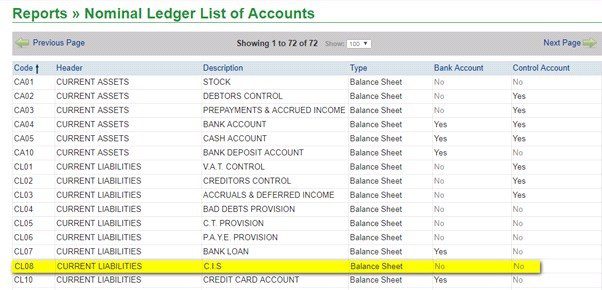

Create a new Nominal Ledger Balance Sheet account called CIS as shown below.

Post the payment as normal – Nominal Payment which will be for the full amount (including CIS Deduction) to subcontract labour Nominal code, e.g. PU02. If the subcontractor is not registered for VAT, then use VAT Code N.

This will now have overstated the amount paid to the subcontractor, so the next step is to post a Nominal Receipt to e.g. CL08 for the tax deducted – ensure you use the same reference and date in order to match them on the bank reconciliation.

If you process a subcontractor’s invoice through the purchase ledger then post the invoice in full coding the VAT either as standard (If VAT shown) or as VAT Code N (if no VAT). Depending on the Subcontractor’s status raise a credit note for the CIS deduction due and post the amount or CIS Deductions due – e.g. CL08.

Use the subcontractor’s UTR/CIS number as a reference.